Source: e company

[Introduction] Implement again! Gree Electric spent 3 billion yuan to buy back shares within 2 months.

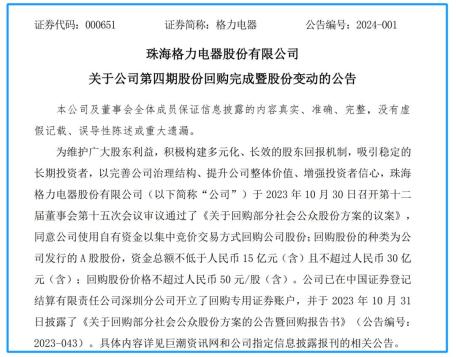

Gree Electric (000651) completed the repurchase plan again.

On the evening of January 1, 2024, Gree Electric announced that by December 29, 2023, the company had completed the share repurchase plan, with a total purchase of 91.898 million shares, accounting for 1.63% of the total share capital, and invested 3 billion yuan.

Four consecutive top-level repurchases

According to the previous buyback plan, the buyback range of Gree Electric is 1.5 billion-3 billion yuan. Judging from the actual completion, the company has implemented the aforementioned buyback plan.

Judging from the implementation progress, this round of repurchase in Gree Electric is quite rapid. Since the release of the repurchase program on October 30, the company has completed the repurchase task in only two months.

Specifically, the first repurchase occurred on November 7, and the single-day repurchase amount was 36.6946 million yuan; As of December 11, the cumulative repurchase amount reached 2.013 billion yuan, and the number of shares repurchased exceeded 1% of the total share capital; In the following more than half a month, nearly 1 billion yuan was repurchased again until the repurchase plan was implemented on December 29.

At present, all the shares repurchased this time are deposited in the special securities account for repurchase, and Gree Electric will use the opportunity to implement the equity incentive or employee stock ownership plan.

The reporter of Securities Times E Company noticed that including this repurchase, Gree Electric has implemented four repurchases since 2020, and all of them have successfully completed the plan, with a total repurchase amount of about 30 billion yuan. Specifically, the first three buybacks were concentrated in 2020-2021, and the planned buybacks were 3 billion-6 billion yuan, 3 billion-6 billion yuan, and 7.5 billion-15 billion yuan, respectively, and the final buybacks all reached the upper limit of 6 billion yuan, 6 billion yuan, and 15 billion yuan.

During this repurchase period, some senior executives in Gree Electric also bought. The announcement shows that Deng Xiaobo, the company’s director, vice president and secretary-general, bought 7,000 shares of the company during the repurchase period, and Duan Xiufeng, the supervisor, bought 156,300 shares. Gree Electric said that the above two people’s stock trading behavior is their investment decision based on market public information and personal judgment.

In the secondary market, since the release of the repurchase program, Gree Electric’s share price has declined slightly, with an interval drop of about 5.5%, and it recently closed at 32.17 yuan/share, with a market value of 181.2 billion yuan.

The performance in 2023 rose steadily.

Behind Gree Electric’s frequent repurchase program is its strong financial strength and steady performance.

Gree Electric has always been famous for its "cash cows". By the end of the third quarter of 2023, the balance of book monetary funds in Gree Electric reached 181.989 billion yuan. In terms of shareholder feedback, since its listing in 1996, the company has accumulated dividends of over 139 billion yuan, including cash dividends of over 110 billion yuan.

In December 2023, Gree Electric released its annual performance forecast, and it is estimated that its revenue will reach 205-210 billion yuan in 2023, up by 7.8%-10.4% year-on-year; It is estimated that the net profit will be 27 billion to 29.3 billion yuan, with a year-on-year growth rate of 10.2% to 19.6%; The net profit after deducting non-profit was 26.1 billion-27.8 billion yuan, an increase of 8.8%-15.9% year-on-year; The basic earnings per share was 4.82 yuan/share-23 yuan/share, up 8.8%-18.1% year-on-year.

Regarding the reasons for the steady increase in performance, Gree Electric said that the company has always focused on the main business of air conditioning, adhered to the guidance of consumer demand, enriched product categories, and actively expanded sales channels; At the same time, we will continue to carry out industrial transformation and continue to exert our strength in diversified fields such as high-end equipment, industrial products and green energy, providing growth momentum for performance.

On December 19, 2023, Gree Electric announced that it planned to acquire 24.54% shares of existing shareholders of Gree Titanium New Energy Co., Ltd. (hereinafter referred to as "Gree Titanium"), a holding subsidiary, at a price of 1.015 billion yuan, and will hold 72.47% shares of Gree Titanium after the equity delivery is completed; According to the plan, Gree Electric will take the opportunity to acquire the remaining shares of Gree Titanium in the next 12 months, with the transfer ratio not exceeding 27.53%.

As an important layout of Gree Electric’s new energy sector, Gree Titanium is mainly engaged in research and development, production and sales of lithium titanate battery core materials, batteries, intelligent energy storage systems and new energy vehicles. At present, its new energy commercial vehicles have been operated in more than 230 cities including Beijing, Shanghai, Guangzhou, Chengdu, Nanjing, Tianjin, Wuhan and Zhuhai. Since it was included in the consolidated statements of listed companies in 2021, the business scale and gross profit of Gree Titanium have been greatly improved. In 2022, it achieved revenue of 2.587 billion yuan and gross profit of 413 million yuan, with year-on-year growth rates of 27.69% and 230.2% respectively.

Gree Electric said that its industries cover two major fields: household consumer goods and industrial equipment, and are currently diversifying along the upstream and downstream of the industrial chain. Specifically, it extends upward to compressors, motors, chips, enameled wires, copper rods, capacitors, etc., and extends downward to the green recycling of waste household appliances, and cuts into the industrial chain of new energy vehicles, energy storage and battery manufacturing equipment through acquisitions, etc., realizing independent control of core components.

Original title: "Gree Electric, Re-implementation"

Read the original text