Every editor, He Xiaotao, Zhang Jinhe

On the evening of October 8, 2023, Hengda Automobile announced the resumption of trading and disclosed the latest progress of the war investment.

Evergrande Motor said in the announcement that on September 29, 2023, it received a letter from Newton Group stating that,In light of Evergrande’s announcement of the suspension of trading of its shares on September 28, 2023, together with a series of recent changes in China Evergrande, this in turn will also create significant uncertainty regarding the share purchase agreement and the proposed transaction.According to the share purchase agreement, the completion of Hengda Group’s workout and a series of other prerequisites are very important prerequisites for delivery. In this case, Newton Group suspends the relevant obligations in the share purchase agreement.

According to the Financial Union, the reporter checked the relevant announcements and found that,The problem mainly focuses on the changes in the overseas workout of Hengda Group, the parent company of Hengda Automobile, and the related impact on Hengda Automobile after Xu Jiayin, the board of directors of Hengda Group, was taken compulsory measures.

Hengda Automobile Emergency Announcement

Holding hands with Newton to regroup and change?

According to the announcement, Newton Group said that according to the transitional funding support agreement, due to the current situation that the preconditions under the share purchase agreement cannot be met, Newton (Zhejiang) Automobile to Hengda New Energy Vehicle (Tianjin) The preconditions for the payment of the second and third funds have not been met, and it is temporarily not obliged to pay the second and third funds to Hengda New Energy Vehicle (Tianjin).

In addition, Newton Group also hopes that Hengda Automobile will reply to clarify the following aspects:

First, the Hengda Group workout plan involved in the share purchase agreement needs to be readjusted, and there are plans to launch a new restructuring plan;

Second, China Evergrande, Evergrande Automobile, creditors and related parties are willing to renegotiate the adjustments required for the proposed transaction plan on the premise that the new restructuring plan is clear.

Third, Newton Group confirmed that the letter sent to Hengda Automobile does not constitute a notice to terminate the share purchase agreement.There is no requirement to terminate the share purchase agreement as of the date of issuance.

Evergrande Motor pointed out that on October 5, 2023, it sent a reply to Newton Group, expressing its willingness to renegotiate with it the necessary adjustments to the proposed transaction plan. Evergrande also said that it will make further announcements in accordance with the listing rules and the takeover code in due course.

Evergrande’s board of directors believes that there is no other insider information that needs to be disclosed at present.It has applied to the Stock Exchange to resume trading from 9:00 am on October 9, 2023.At the same time, Evergrande also cautioned that as the proposed transaction may not proceed, shareholders and potential investors should exercise caution during the transaction.

On the evening of August 14, Hengda Automobile (0708.HK) announced that it had received the first strategic investment of 500 million US dollars (about RMB 3.63 billion yuan) from the US-listed company Newton Group (NWTN), which is held by the UAE sovereign fund. Another 600 million RMB transition funds will arrive one after another 5 working days after the announcement.

All war investment funds are used in Hengda Automobile’s Tianjin factory to ensure the normal production of Hengchi 5 and the successive mass production of Hengchi 6 and 7. It is reported that NWTN Group will also assist Hengda Automobile to develop overseas markets and achieve the annual export of 30,000-50,000 Hengchi vehicles to the Middle East market.

Before the suspension,Evergrande Motor shares 0.56 Hong Kong dollars, market value 6.073 billion Hong Kong dollars.

Hengda’s latest debt 75.60 billion yuan

Delivered 760 Hengchi 5s in the first half of the year

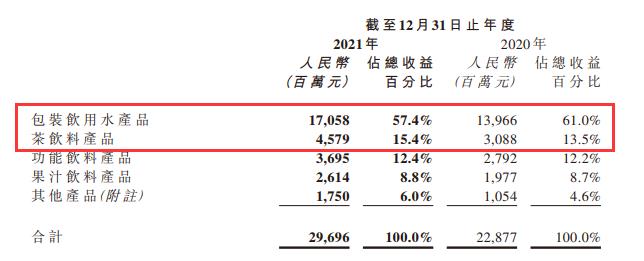

On the evening of September 21, Hengda Automobile released the 2023 semi-annual report showing that as of June 30, 2023, the company’s total assets 42.852 billion yuan (RMB, the same below) and total liabilities 75.692 billion yuan.

As of June 30, 2023, Evergrande Motor’s huge liabilities were mainly from borrowings, trade and other payables, and other liabilities. Among them, borrowings, trade and other payables all increased.

As of June 30, 2023, Hengda Motor borrowed 26.997 billion yuan, up 1.011 billion yuan from 25.985 billion yuan at the end of 2022.

As of June 30, 2023, Hengda Motor was involved in the failure to pay off the maturing debt of about 9.341 billion yuan, and the overdue commercial ticket accumulated about 3.591 billion yuan.

In the first half of 2023, Hengda will focus on the production and delivery of Hengchi 5, with more than 760 vehicles delivered.

Who is the Newtown Group?

According to Life Daily, Newton Group (NWTN) is the "pacesetter" of new energy vehicles in the UAE, and it has deep connections with China. Newton Group was formerly known as the Tianjin-based company Ikonik. After "Nirvana", Newton Group received capital from the UAE Royal Fund and was established in Dubai in 2016. Today, Newton Group is controlled by the UAE Royal Group. It has unique advantages in core technologies such as modular pure electric platforms, digital on-board interconnection systems, electrical and electronic architecture, and autonomous driving. Ultra-car, full-size SPV, and compact SPV are the main products that Newton Group is developing.

As the first manufacturer to obtain a new energy vehicle production license in Abu Dhabi, the strength of Newton Group should not be underestimated. In May 2022, Newton Group announced that it signed a PIPE subscription agreement with Al Ataa Investment LLC (hereinafter referred to as LLC) in Abu Dhabi, UAE, with a total amount of 200 million US dollars. LLC is the UAE Royal Assets Company, which is not only an important part of the UAE economy, but also represents the national intention of the UAE’s special political system. This subscription shows the strong support of the UAE for new energy vehicles, and also shows the country’s determination to develop local new energy vehicles.

With the strong support of the UAE government, Newton Group successfully "landed" on Nasdaq in the United States on November 14, 2022, becoming the first stock of UAE new energy vehicles listed in the United States.

Before putting on the coat of "the first share of new energy vehicles in the United Arab Emirates", Newton Group was active in domestic and foreign markets as the "Iconic" brand.

According to Iconic’s official Weibo chat history, in September 2016, Tianjin Iconic New Energy Vehicle Co., Ltd. was established. In April of the following year, the company brought its first pure electric MPV to the Shanghai Auto Show and claimed that it had won nearly 10,000 pre-orders at home and abroad before it was listed. The first batch of new cars will be delivered in 2019.

Image source: Weibo screenshot

Similar to the "hot-selling" news of the product, there are also its big-name partners that have been officially announced, such as product design by W Motors, a Middle Eastern supercar manufacturer, prototype car building by Turin studio, and working with Microsoft to create future smart travel solutions.

However, as the time came to 2019, Iconic did not release more news on the delivery of orders. But at the same time, the company is still revealing new "highlights". According to a report by China News Service in April 2019, during the 2019 Shanghai Auto Show, Iconic founder and president Wu Nan announced that Iconic established Tianjin Tianqi New Energy Vehicle Co., Ltd.

In July of the same year, Tianjin Aikonik New Energy Vehicle Co., Ltd. was renamed Tianjin Tianqi Group Co., Ltd. At that time, many media reported that Aikonik and Tianjin Jinghai District Government, Tianjin Baili Machinery Equipment Group Co., Ltd. and Tianjin Jinghong Investment Development Group Co., Ltd. reached an agreement on the transfer of equity of Meiya Automobile, and thus obtained the car manufacturing qualification.

Inside the registered place of Tianjin Tianqi Group, picture source: Photo by Li Xing, every reporter

According to the news released by Tianjin Jinghai District Rongmedia Center in 2019, the Tianqi New Energy Vehicle Headquarters project will be settled in Jinghai District Ziya Economic and Technological Development Zone. The project is divided into two phases as a whole. The first phase starts the new energy vehicle production base project, and the planned annual production capacity is 50,000 new energy MPVs. It is expected to start construction in October 2019 and be completed and put into operation in October the following year.

However, there is no public information on the progress of the project.

Previously, a reporter from the "Daily Economic News" called the investment project department of the Jinghai District Government Service Office to inquire about the follow-up progress of the aforementioned project. After the other party’s inquiry, the project was not established in the system. "[The project unit at that time] may have an agreement with the district government, but it may only be a framework agreement, or a strategic agreement. In the end, the project unit may not be cost-effective (think) it is not suitable, or the supporting site selection may feel that there is a problem, and it will not be connected. Then the project will be completed in the end."

The content of the article is for reference only and does not constitute investment advice. Investors operate accordingly at their own risk.

edit|He Xiaotao, Zhang Jinhe, Gaiyuanyuan

Proofreading |Chen Keming

Daily economic news comprehensive Hengda announcement,

Daily economic news comprehensive Hengda announcement,

Daily Economic News (reporters: Zhu Chengxiang, Li Xing, Yang Yu), Financial Union

[Ask the world M7 sold out, many players optimistic about the opportunity of the industry chain! The competition will enter the second half, get on the car to win the grand prize] Mid-Autumn Festival National Day holiday is over, class A share will open from next Monday. During the holiday, Hong Kong stocks Hang Seng Index and A50 index fell first and then rose, and finally rose slightly. In the 19th official competition of the gold nugget competition held by the Daily Economic News APP, next week will enter the second half. At present, many players are actively registering and running. News shows that since the release of September 12, the cumulative quantity of the new M7 has exceeded 50,000 vehicles. Some contestants believe that it is estimated that the market will rebound next week, and they are optimistic about the opportunity of the ask world M7 industry chain. This registration period ends at 24:00 on October 11, and the competition time is from September 25 to October 13. Download and install the Daily Economic News APP, register now, and compete for the cash prize!