Three years after being acquired by Foxconn, Sharp is looking for a new way to survive.

On May 21st, Sun Yuewei, general manager of Sharp China, told reporters that Sharp began to refocus on mid-to high-end products and return to the technical standard.

A month later, Sharp will determine whether the new board list will take effect. If nothing happens, Hu Guohui, Lin Zhong Zheng and Chen Weiming will join the board of directors. Their common background is from Hon Hai Group (also known as Foxconn).

At the end of March 2016, Foxconn announced the acquisition of Sharp’s equity with a total transaction price of 388.8 billion yen. On April 2, Foxconn signed a contract with Sharp, and the four-year acquisition negotiation was finally completed. After the completion of the acquisition, personnel adjustment, strategy change and repositioning frequently occur. Now, the operation is quite successful. One year after the acquisition, Sharp reduced its losses by nearly 90% in FY 2016 and returned to the main board of Dongzheng at the end of the year. In fiscal year 2017, Sharp’s net profit was 70.2 billion yen, achieving its first profit in four years. In 2018, Sharp failed to achieve double growth in revenue and profit. Some people believe that Foxconn’s sharp price cut on Sharp once damaged this century-old number, and the shrinking brand value caused controversy.

Because of the controversy over performance, the outside world doubts whether the global foundry giant Foxconn has really mastered Sharp, and speculates whether Sharp will change hands again. This led Sharp to make a public response. In April 2019, the company denied the existence of plans to sell TV business, and in May, it put forward new business strategies such as "black and white progress" in the United States, China and other markets.

It took four years for Guo Taiming to "eat" Sharp.

For Sharp, Foxconn was once a rescuer of business and an ally against Samsung Electronics.

Nine years ago, in the summer, the then president of Sharp, Kanxiong Katayama, met with Guo Taiming to discuss patent licensing and capacity distribution cooperation, because the 10th generation line panel factory in Bengbu, which Sharp was proud of, was facing the dilemma of inefficiency.

Two years later, in March 2012, Foxconn invested about 133 billion yen in Sharp and bought 9.9% of the shares. Guo Taiming also personally invested in Sharp Display Manufacturing Company (later SDP), the operating company of the factory, holding 46.5% of the shares, which is the same as that of Sharp.

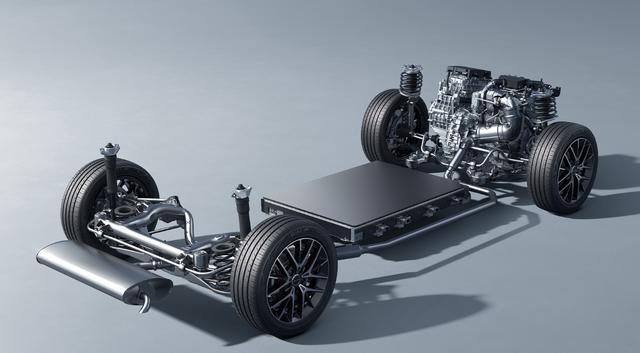

For this investment, nine years later, Sun Yuewei and many other people familiar with the matter told the Beijing News reporter that the factory was the only 10th generation line in the world at that time, which was of great significance to the large-panel color TV business. Generations are divided according to the size of glass substrates. The 10th generation line can cut six 65-inch, eight 55-inch or 57-inch panels, and mastering the production capacity is the key for downstream enterprises to participate in the competition.

And let Guo Taiming make up his mind to buy the whole Sharp, which stems from the delay of many subsequent cooperation.

At that time, Foxconn was already the OEM of Apple’s iPhone and iPad, and Sharp was the main panel supplier of Apple equipment. However, the contradiction between different executives within Sharp Company has led to several delays in cooperation with Foxconn. Guo Taiming couldn’t help but speak his mind. "In this case, I will simply buy the whole Sharp." Japanese media quoted people familiar with the matter as saying that Sharp panicked because its interest-bearing liabilities had reached about 1.1 trillion yen at that time.

Not only that, Sun Yuewei told reporters that Foxconn has been undergoing transformation and needs various technical sources. At that time, many top Japanese companies such as Sharp were discussing technology transfer, hoping to combine Japanese manufacturing technology with the huge domestic market and Foxconn’s advantages.

In June 2012, Guo Taiming said that cooperation with Sharp would help defeat Samsung Electronics.

However, Guo Taiming’s acquisition of Sharp was not smooth. Shortly after Sharp reached an agreement with Foxconn, its share price began to plummet. Guo Taiming demanded a substantial adjustment of relevant conditions, and expected to directly participate in the operation, instead of just providing financial assistance to Sharp like the banking industry. He once told the media that "it is just like not giving children pocket money". The agreement between the two sides broke down.

In 2015, Guo Taiming and Gao Qiao Xingsan, then President of Sharp, did not meet again to discuss Sharp’s reform. In 2016, Sharp and Foxconn signed a priority negotiation agreement under a series of commitments, including not splitting the company and not abolishing employees under 40. However, Foxconn soon slowed down the negotiation process, because Sharp broke the contingent debt worth about 20 billion yuan, which was close to half of the offer with Foxconn. Therefore, Foxconn asked for an in-depth audit.

In this process, Sharp disclosed its quarterly results with a net loss of 108.3 billion yen, but it did not solve the financial shortage through layoffs, asset sales and bank loans. With this opportunity, Foxconn was able to lower the price. When it was announced on the afternoon of March 30, the total price of Foxconn’s final contribution was 388.8 billion yen.

A few days later, on April 2nd, Guo Taiming, Dai Zhengwu and Gao Qiao Xingsan attended the signing ceremony. Guo Taiming was in high spirits at the meeting place, and expressed his position to transform Sharp with the "working spirit of seven days a week". Later, Dai Zhengwu became the president of Sharp, lived in the dormitory with employees, and arrived at the company before 7: 10 every day.

A month later, Dai Zhengwu announced his goal of turning losses into profits in the second half of that year, which was one year earlier than previously expected. Sharp has lost more than 200 billion yen for two consecutive years.

Layoffs and price cuts, Guo Taiming went into battle to squeeze profits.

On May 17th, Sharp announced the list of candidates for the next director, and the current president Dai Zhengwu is still in the list of candidates for the next director. It is worth noting that the current Sharp directors Liu Yangwei and Wang Jianer will both withdraw from the next Sharp Board of Directors. Earlier, some foreign media speculated that Liu Yangwei was the successor of Guo Taiming, chairman of Hon Hai Group (Foxconn), or would become the chairman of Hon Hai.

Dai Zhengwu is the first foreign president in Sharp’s eight-year history. He is a Japanese expert in Foxconn and is known as "Dai Sang". He helped Foxconn win orders for Sony PS2 game consoles and entered Sony’s supply chain. Before taking charge of Sharp, he was in charge of the vice president of Foxconn Consumer Products Group and Important Peripheral Function Group.

Dai Zhengwu has a tough style. He sent two open letters to 47,000 Sharp employees in a month, announcing the reform. Japanese media reported that when Dai Zhengwu mastered Sharp’s household appliances, electronic parts, LCD, solar cells and other businesses, he asked the management to respond to his questions as soon as possible through video conference, and set up a president’s office with 200 employees to decide all personnel appointment and dismissal rights, and refused to meet with external directors to discuss.

One of Dai Zhengwu’s specialties is dismantling costs and squeezing out profits. For the transformation of Sharp, Dai Zhengwu’s three axes include layoffs, price reduction and distribution reduction. The scale of layoffs was initially considered at 1000, and was eventually expanded to 7000. At the same time, in order to reduce the cost, Dai Zhengwu transferred the purchase to Foxconn, and cleared the inventory through Foxconn’s e-commerce platform Fulian. During double 11 in 2016, Sharp even launched a "buy big and get small" promotion in China market, that is, buying a 70-inch TV and giving away a 60-inch TV.

This is inseparable from the support of Foxconn Guo Taiming. The Sharp product promotion project led by Foxconn was named "Tianhu Plan", and Guo Taiming even took the command personally.

In September 2017, in order to prepare for double 11, Foxconn even announced that as long as it sells one piece of equipment, it will have a promotion fee of 50 to 300 yuan; Externally, Guo Taiming put forward the slogan of "noble but not expensive", and announced that he would build a production line in mainland China and invest 61 billion yuan to set up a 10.5-generation line 8K display eco-industrial park in Guangzhou.

Not only that, Sharp also reduced the configuration. Since the LCD screen accounts for nearly 70% of the TV cost, Sharp gave up the original Sharp screen on the low-end products, but chose the LCD screen produced by Innolux, a lower cost subsidiary of Foxconn. In addition, the frame and chip of the fuselage have been replaced with standards. Chen Zhenguo, vice president of Foxconn, repeatedly stressed that low prices and high-end products did not conflict.

One year after the acquisition, Sharp announced a loss of 25 billion yen in fiscal year 2016, a decrease of about 90% compared with the loss of 255.9 billion yen in fiscal year 2015. In FY 2017, Sharp’s sales increased by 18.4%, achieving revenue of 2.43 trillion yen and net profit of 70.2 billion yen, achieving its first profit in four years. Because of the remarkable effect, Sharp proposed the goal of selling 10 million LCD TVs worldwide in FY 2018, which is twice that of FY 2016. This target was subsequently raised to 14 million units. Sharp further proposed a plan to increase operating profit by 2.5 times in the next three years.

This is a whole set of Foxconn OEM logic, hitting the market at a low price and concentrating resources to fight for business.

However, behind the turnaround, Foxconn’s adjustment of Sharp’s market strategy also ignited the fuse for the first major crisis after the acquisition of Sharp. On May 10, 2019, Sun Yuewei, general manager of Sharp China, said in an interview that only about 80% of the annual target was achieved in 2018.

Sun Yuewei told reporters that in April 2018, he was asked to enter Sharp. Previously, he was responsible for the business of panels, which was the upstream of TV and other devices with screens.

The "Tianhu Plan" ends and goes back to the high end.

Some consumers report that it is difficult to associate such a low-priced product with SHARP’s brand if the trademark "Sharp" is not printed on the front of the product. GfK analyst Li Mo told reporters that the main difference between international TV brands in the domestic market is their high-end brand image.

Zhongyikang data confirmed the process of Sharp’s cliff-cutting price reduction. The average price of Sharp TV has dropped from about 6,000 yuan in early 2016 to about 3,800 yuan in May 2017.

In addition, behind Foxconn’s massive cost reduction, complaints about Sharp TV are also rising.

Due to the strategy of selling one machine and losing one machine to seize the market, Foxconn’s net profit in the second quarter of 2017 decreased by 36% month-on-month and its operating cost increased by 9.1%. This pattern of seizing the market did not last long. Sharp TV, which broke into the top five in the world in the first half of 2017, slowed down in the second half of the year, ranking only eighth in the whole year.

In the second half of 2018, Sharp finally realized the crisis.

In September, Dai Zhengwu spoke to hundreds of Chinese mainland dealers at the Foxconn factory in Shenzhen, saying that Sharp will pursue a balance between quality and quantity growth in the China market in the future. This is regarded by the industry as the end declaration of the "Tianhu Plan". Not only that, Dai Zhengwu stopped the decision to entrust the sales in China market to Fulian. com, a subsidiary of Foxconn, in the past two years.

Sun Yuewei explained that Sharp began to refocus on high-end products and return to the technical standard. Regarding Foxconn’s strategy before September 2018, he thinks that this has laid a foundation for the China market. After taking over the business in September, all he has to do is to promote Sharp to get the support of consumers. The method is to change from the strategy of pursuing "quantity" to pursuing "quality" because consumption upgrading is just needed under fierce competition.

A few days ago, Sharp released 8K TV and AIoT white goods in Guangzhou. This is regarded by the industry as Sharp’s return to the old road of cultivating brand value with cutting-edge technology.

In addition, according to Japanese media reports, Sharp announced that it will launch a 5G smartphone as early as the spring of 2020.

In order to cope with the new competition, Sharp adjusted its daily management mode. In addition to being led by the president, Sharp has established a management committee, including the heads of R&D, supply chain, products, sales, logistics and after-sales, which is responsible for all policies and strategic layout. This management committee meets twice a month to discuss issues, make final decisions and implement them. The reason why discussions are held so frequently is that it is due to market competition, and it is necessary to improve the accuracy of planning and forecasting, so it is necessary to correct the implementation results in time.

Stopping Foxconn is an important step to restore Sharp’s brand value. Guo Taiming once took a fancy to Sharp brand to fulfill his long-standing brand dream. Foxconn once launched its own brands such as "InfoVision", but they were all submerged in the market and failed to get rid of the label of "OEM Empire".

Enter the 8K competition, keep the basic disk of black electricity and introduce white electricity.

In November 2018, the focus of Sharp’s promotion activities turned to small household appliances such as Sharp water purifiers and air purifiers, and the crazy promotion of Sharp TV disappeared.

In May 2019, Sharp announced that "black and white progress" has become an important strategy for the China market this year. The so-called "black-and-white progress" means that while promoting 8K TV, Sharp has made efforts to produce white goods such as refrigerators and air purifiers. Due to the limited increment of the black electricity market dominated by color TV, in the next year or two, Sharp needs to maintain the fundamentals of black electricity while ensuring profits through white electricity, thus entering the market competition in the 8K stage.

For Sharp, it is not easy to keep the basic disk of TV. A technical expert from a color TV company in China told reporters that 8K does not mean industrial revolution, but technological innovation. Therefore, 8K can’t form a drastic industrial change like flat-panel TV replacing CRT TV, and the bottleneck of TV industry itself needs a breakthrough in physical and chemical technology. For the production of 8K TV, the threshold is not high, because the supporting industries such as content are not yet mature, and it is difficult to sell the products on a large scale.

As for why Sharp attaches importance to 8K, the technical expert told the reporter that because 8K has a driving force on the brand itself, it can enhance the premium space. It can be seen that the increase of 8K TV in 2020 will be more obvious than that in 2019, but in the long run, 4K TV has not been popularized, and it may take 8 to 10 years for 8K TV to reach the level of 60% share.

At present, the single product profit of 8K TV is higher than other types of products, but there are only four or five thousand plates in the domestic market, and there are not many brands. The expert said that the main purpose of 8K TV at present is to support the facade. Manufacturers are not active in entering the commercial market, because the price transparency leads to meager profits, and the project credit may lose money and earn money.

Not only that, Sharp has to face fierce market competition. GfK analyst Yang Yizhen told reporters that Xiaomi’s low-price strategy has made it rise all the way since 2017. Its TV price is 10%-20% lower than that of domestic brands, and the average price is 1,800 yuan in 2018. It is the only TV manufacturer with an average price of less than 2,000 yuan in China.

The agency predicts that the sales volume of official website Xiaomi, including the brand, may reach 10 million units in 2019, while other traditional TV manufacturers in China will only reach about 6.5 million units at most. Sharp ranked behind the six major domestic products and Xiaomi in 2018, because it changed its strategy of impacting sales, which was lower than that in 2017. However, due to the limited supply of 8K panels, manufacturers with resources give priority to self-supply, thus gaining the monopoly advantage in the initial stage of the market and maximizing it.

Sun Yuewei said that in FY 2017, further losses have been prevented, and in FY 2018, profits began to be made. Next, the color TV market is very big, but the competition will be fierce, and it will be difficult to make a profit alone. Therefore, in addition to improving the competitiveness of products and making profits, introducing white electricity and expanding operations on the basis of black electricity will balance the overall profitability.

Sun Yuewei said, "In 2017, we began to discuss the introduction of white electricity, and decided to start implementation from September 2018."

For white electricity, the current strategy is that refrigerators and washing machines will be introduced in all markets to meet the needs of consumers’ daily life, but different products will be selected according to different regions and seasons for special needs. Sun Yuewei takes the smog in Northeast China and North China as an example, and will introduce air purifier products with mature technology in this area. In addition, Sharp also conducts research and development for beauty appliances and pet appliances, and plans the order of product research and development according to the needs of smart homes.

White electricity is difficult to fight price wars, and smart homes are not popular.

Sun Yuewei told reporters that there are two main types of consumer groups that Sharp is currently targeting. One is the traditional 40-year-old people who buy household appliances in a traditional way of thinking, while the other is the younger consumer groups around 20 years old, who are no longer price-oriented. However, for the market forecast in 2019, Sun Yuewei thinks that it can only be completed after the "618" promotion activity, because the China market has declined from January to April 2019 due to the international environment, but this does not represent the annual data.

For Sharp, the white electricity market cannot use the strategy of "low price for quantity". Li Mo told reporters that at present, the white electricity market in China mainly covers most categories with Haier and Midea, and there are giants such as Gree in sub-sectors such as air conditioning. White electricity is a consumer goods market with a slower iteration cycle, which is closely related to the population trend and the real estate industry.

Usually, the iteration period of air conditioner is 5 to 8 years, washing machine is 8 to 10 years, and refrigerator is 10 to 12 years. Only when the user realizes the replacement or product damage will he buy it, and the discount is only an additional item in the purchase. The last home appliance growth period in China was around 2009, when home appliances went to the countryside, which expanded the new market.

Not only that, Li Mo said that the white electricity market is not good for making money. In 2018, the household retail channels of multiple categories declined significantly. The sales volume of air conditioners decreased by 0.2%, refrigerators decreased by 5.2%, and washing machines decreased by 2%. Moreover, in multiple sub-categories, head players account for more than 50% of the market, and manufacturers are no longer willing to fight price wars. First-line brands gradually give up the low-end market in pursuit of profits.

With the view of the Internet of Everything recognized by the industry, Sharp proposed the strategy of 8K+AIoT (Artificial Intelligence and Internet of Things) two years ago. Dai Zhengwu once explained that the AIoT strategy covers the fields of smart home, smart office, smart factory and smart city, and Sharp will provide COCORO+ ecological platform, making it a self-circulating and expanding system.

Although smart home is the development direction of manufacturers, the demand of consumers is still related to actual use, and the scene demand of smart home is not obvious, and consumers are not willing to buy all household appliances with the same brand packaging scheme. A vice president of a white goods manufacturer told reporters that there is no timetable for the popularization of smart homes.

Foxconn promotes the recovery of assets such as intellectual property sold by Sharp.

Sharp, founded in 1912, has focused on and led LCD panels and related industries for decades. Sharp, known as the "father of LCD", LCD TV once occupied 40% of the global market share. Around 2012, when Sharp faced bankruptcy, it transferred some intellectual property rights to raise funds. Dai Zhengwu once said that there are plans to gradually recover the assets sold.

In the second half of 2016, Sharp and Foxconn established an intellectual property management company, ScienBiziP Japan. According to the data, this company has a registered capital of 49,000 US dollars and is headquartered in Osaka, Japan. Sharp holds 51% of its shares, Foxconn’s ScienBiziP Bizip Consulting Company holds 20%, and the management holds 29%. ScienBiziP Japan was previously the intellectual property department of Sharp, and promoted the trading of Sharp’s patent portfolio after the establishment of an independent company.

The president of ScienBIzIP Bizip Company is YP Jou, that is, Zhou Yanpeng. According to public information, Zhou Yanpeng served as general counsel for Foxconn for 18 years, served as the legal chief of Foxconn and participated in Foxconn’s strategy formulation. Zhou Yanpeng once said that in recent years, Foxconn’s business has undergone great changes, giving up many patents, and focusing on the intellectual property deployment of 5G and 8K technologies and key components.

After taking control of Sharp, Foxconn wants to get back the assets acquired by Hisense. In July 2015, Hisense acquired the entire equity and assets of Sharp Mexico Company for US$ 23.7 million, and obtained the brand use right and channel resources of Sharp TV in the Americas for five years. According to the original agreement, Hisense will operate the Sharp North American brand until January 5, 2021.

In June 2017, Foxconn filed a lawsuit against Hisense in the California court, accusing Hisense of using Sharp brand to sell low-quality and low-priced TV products in the United States to damage its brand image, demanding that it stop using trademarks and compensate for the loss of 100 million US dollars. Although this incident ended in Sharp losing the case, analysts pointed out that Foxconn’s move was eager to save Sharp’s declining brand image.

In May 2019, Sharp shook hands with Hisense and regained Sharp’s brand use rights and sales business in the US market. Sharp plans to relocate in the US market in the third quarter of 2019 and catch up with the peak sales season at the end of the year. Sun Yuewei told reporters that the US market is being re-planned, while other major markets of Sharp include China, Japan and Europe, and more resources will be invested in the future.

In addition to restarting Sharp’s US business, Sun Yuewei is also responsible for promoting the construction of Foxconn’s 6th generation line project in Wisconsin. In July 2017, Foxconn announced that it would invest $10 billion to build a factory in this area to produce LCD panels for televisions and other electronic products. Due to the change of the state government, the progress of the project was once hindered.

In April 2019, Foxconn issued a statement saying that it looked forward to further consultations with the current governor and his team on cooperation. A week ago, Sun Yuewei went to America on business. He told reporters that as a manager of Sharp, he must adapt to the cultures of many countries. While gaining a foothold in China, Sharp has focused on other markets.

Beijing News reporter liang chen Editor Liu Xiaoyang Proofread Li Xiangling