(Text/Xie Hongjuan Editor/Ma Yuanyuan) On November 9, 2023 Oriental Beauty Valley International Cosmetics Conference was officially opened. The "Blue Book of Oriental Beauty Valley 2023" (hereinafter referred to as "Blue Book") released at the conference showed that the beauty market entered the raw material bonus period. Most consumers say that China people have a long history of studying herbal raw materials. Compared with other chemical raw materials, herbal raw materials are safer and more suitable for China people’s physique. They can also help farmers help the poor and help the local economy.

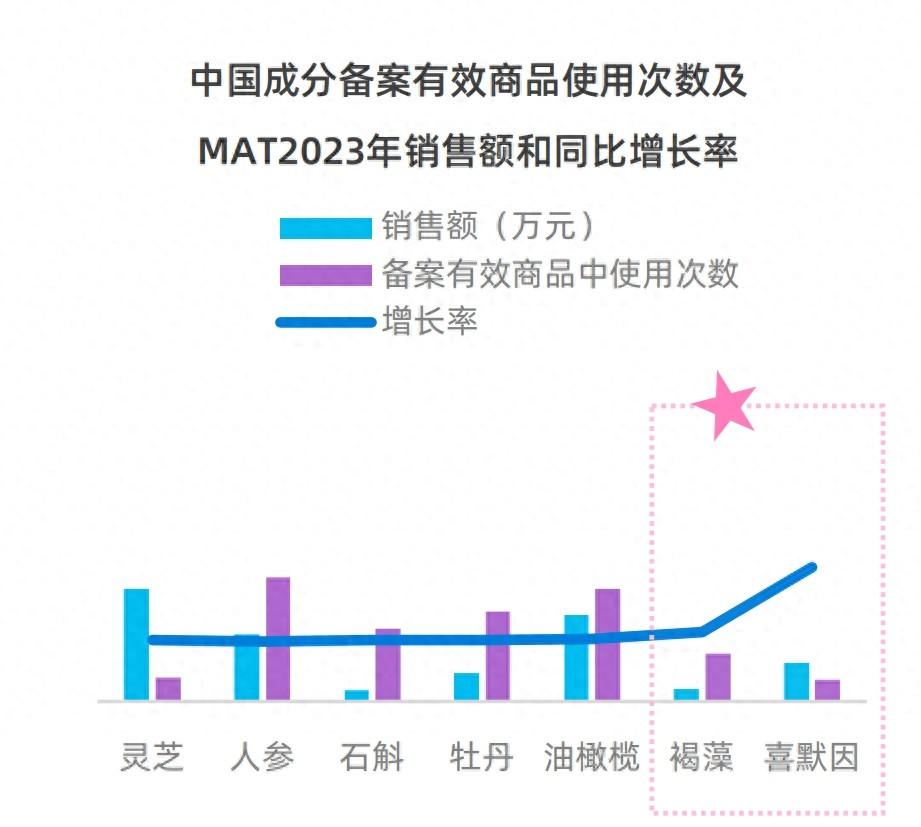

Specifically, among herbal raw materials, beauty products containing China-specific ingredients such as Ganoderma lucidum, ginseng, brown algae, and simethine are on the rise.

Take the essence of the small purple bottle of Nature Hall, which has been selling hot recently, as an example. The simethine contained in this product comes from the third class in the world, and grows in the environment with high altitude of 3,355 meters, extremely cold and low oxygen content. It was selected and developed by Galand Group from more than 500 kinds of yeasts after nearly 10 years, and it has magical effects in repairing aging, promoting collagen synthesis and improving dullness.

In order to catch up with the bonus period of raw materials, the China Special Cosmetic Raw Materials Base Alliance of Oriental Beauty Valley was born at the right time, which was unveiled by Chen Jie, Vice Mayor of Shanghai Municipal People’s Government.

It is reported that the alliance was jointly initiated by China Fragrance, Flavor and Cosmetics Industry Association and Oriental Beauty Valley, and jointly established with China characteristic plant raw material planting bases in Yunnan, Anhui, Shandong, Ningxia, Gansu, Sichuan, Xinjiang, Guangxi and other places. Through raw material innovation and Industry-University-Research empowerment, the problems of low technical added value and weak market competitiveness of domestic raw materials were solved. In the future, quality standards related to China’s characteristic plant raw materials will be formulated, and the substitution process of domestic raw materials will be greatly accelerated with "Oriental Meigu Raw Materials" as a booster.

According to public information, Oriental Beauty Valley is known as "the capital of cosmetics industry in China", and at present, it has gathered more than one third of cosmetics enterprises in Shanghai, with an industrial scale of nearly 100 billion yuan, and the total brand value of "Oriental Beauty Valley" has reached 33.878 billion yuan. As one of the international events with the highest specifications and the strongest lineup in the global cosmetics industry, Oriental Beauty Valley International Cosmetics Conference has been successfully held for five times so far.

It should be pointed out that the beauty industry naturally has the ESG characteristics of low pollution, low energy consumption, re-marketing and re-research. With the concept of sustainable consumption taking root in China, Oriental Beauty Valley, together with L ‘Oré al, Shiseido, Estee Lauder, WWD, Galand, Jahwa and many other domestic and foreign cosmetics companies, issued the ESG Joint Proposal of Oriental Beauty Valley, advocating that all enterprises in the cosmetics industry should build together with goals, strategies, plans and effects. Pay attention to environmental protection, be the propagator of ESG concept in fashion industry, fulfill social responsibility, fulfill ESG concept, strengthen corporate governance and be the promoter of ESG concept.

According to the blue book, after the downturn in 2022, the cosmetics market ushered in a new round of rapid growth in 2023. Consumer demand for cosmetics continues to climb. In the first half of this year, the cosmetics industry achieved a year-on-year growth rate of 8.6%, with an average growth rate of 12% in the first three quarters. It is estimated that the total retail sales of cosmetics in the whole year will exceed 500 billion yuan. From the perspective of channel changes, Tmall has declined as the main position of cosmetics, while Tik Tok still maintains rapid growth.

From the breakdown of cosmetics, the market share of personal care products has increased, while the market share of perfume and cosmetics is basically the same. Market growth is mainly driven by the increase of unit price and the increase of single purchase volume. Capital tends to be cautious about investing in cosmetics track, but it still has high investment expectation and enthusiasm for technology and biological skin care track. Cosmetics have gradually entered the era of hard power competition, and technology brands have more say.

On the consumer side, the survey results show that consumers are willing to pay for products that can significantly improve their life quality and get higher happiness. Therefore, consumers tend to pay extra premium for high-quality products, among which post-80s and post-90s are the main consumer groups.

It is worth noting that due to the uncertain growth in the future, consumers have taken a more rigorous look at their own consumption needs, their consumption behavior has become more rational and objective, and the expenditure on impulse consumption is decreasing.

Behaviorally, consumers’ purchase intention is mostly caused by new functional demands or the exhaustion of old things, and the possibility of accidental purchase behavior is low. Before making a real consumption behavior, consumers also began to pay close attention to the practicality of products, compare prices, and make a strategy to determine whether there is a real purchase demand.

Li Xiang, senior director and chief business analyst of CBN, pointed out that at present, the domestic cosmetics industry is characterized by the rebound of market demand, obvious channel differentiation, and the rise of domestic brands’ "technology trend". The "self-satisfaction consumption era" has come, and the beauty raw materials are riding the wind, and beauty, technology and art are constantly blending.

This article is an exclusive manuscript of Observer. It cannot be reproduced without authorization.