Image source @ vision china

Wen Wen CBNData Consumer Station, author He Zhexin, editor Dong Zhifei.

An epidemic has made many beauty brands difficult. Under the dual "protection" of home and masks, the demand for beauty products has dropped to a low point.

However, at the beginning of April, the depressed beauty industry ushered in a shot in the arm: Meishang (Guangzhou) Cosmetics Co., Ltd. got nearly 200 million yuan in Series A financing. Meishang, which was founded in 2018, is one of its most famous brands, and is the first Colorkey in the lip glaze category of Tmall, Laqi.

As a dark horse brand of lip makeup in China, what kind of "explosive experience" does Colorkey Ke Laqi have? For Meishang behind it, how can young domestic beauty companies grow rapidly and gain the contrarian favor of capital?

To answer these questions, CBNData conducted an in-depth interview with Ying Shaofeng, e-commerce partner and e-commerce director of Colorkey Laqi.

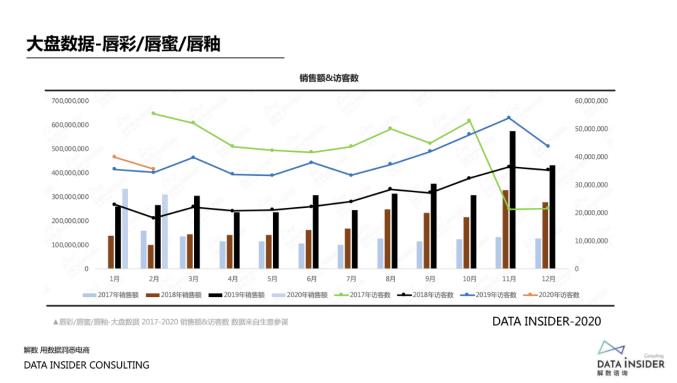

If you are not the target consumer of Colorkey Laqi-the post-95 beauty consumer, you may not be familiar with this brand. But for young girls who love lip glaze, this brand has long been a good idea for many people. According to Alibaba’s official data tool business consultant, Colorkey Laqi has been ranked first in the sales of Tmall Lip Gloss/Lip Honey/Lip Glaze from November last year to March this year.

From the birth to the first category of Tmall lip glaze, Colorkey Laqi has developed rapidly. Founded in 2018, Colorkey Laqi has been listed in the Top 5 of Tmall domestic beauty products in less than one year, and its sales in 2019 exceeded 200 million yuan.

On the day of Tmall double 11 in 2019, Colorkey sold 700,000 pieces of air lip glaze in Laqi, and won the sales volume of lip glaze category No.1 In March, 2020, on the first day of the launch of Mulan lip glaze series, a collaboration between Colorkey Laqi and Disney IP image Mulan, the sales volume exceeded 300,000, and all the popular color numbers were stolen on the spot.

The success of Colorkey KE Laqi in lip glaze is closely related to his timing of category. According to Hong Lei, data analyst of CBNData, the overall scale of lip glaze category in 2018 is still small, and it has not been subdivided from the lipstick market, and it is in a period of rapid development. The data of the business staff also shows that 2018 is the lowest number of visitors to the lip glaze category.

In addition to grasping the outlet of category growth, Hong Lei thinks that Colorkey Laqi is also due to accurate pricing range. CBNData research shows that one of the main consumer groups in the lip glaze market is the post-1995 generation, and their consumption power is weak and they are price-sensitive. Colorkey Laqi’s lip glazes are mostly priced within 100 yuan, aiming at the students in the Z generation.

The goal of Colorkey Laqi is to be the leading brand of lip glaze. Ying Shaofeng told CBNData, "The success of air lip glaze is only the first step. Next, we will build a complete product line of lip glaze, and finally we will set an industry benchmark in the lip glaze market."

At the beginning of 2020, an COVID-19 epidemic appeared, which temporarily chilled lip products. Hong Lei said that under the influence of the epidemic, the overall beauty market was affected. Especially for beauty brands focusing on lip products, timely layout of other categories is one of the ways to save themselves.

Meishang, the parent company of Colorkey Laqi, plans to use the new financing for Meishang to strengthen multi-brand building and accelerate its entry into emerging channels.

Mei Shang owns more than one brand, Colorkey Co., Ltd. Laqi. In 2018, it acquired Korean beauty brand Superface Xiubafei and Taiwan Province skin care brand Lab101 Ruipei, aiming at the needs of mainstream middle-class women in China, and captured market segments through multi-brand strategic layout to meet the beauty needs of women of different classes and incomes. Ying Shaofeng believes that the product matrix of Meishang has covered all age groups.

Colorkey Laqi is also laying out two categories of isolation and makeup fixing besides lip glaze. Ying Shaofeng told CBNData that the growth of the two categories of isolation and makeup has reached more than 50% in the near future. In March, Colorkey Laqi launched a new trend product with high growth category.

In order to shorten the decision-making chain, Colorkey Laqi made full use of big data insight, and adjusted the product strategy in time according to the consumption trend with the operation mode of "small recovery in one week and big recovery in one month". "The beauty industry is updating faster than you think, and it will be eliminated if you don’t pay attention." Ying Shaofeng said.

In improving the product strength, Ying Shaofeng said that he would participate in the color selection of new products in each season. Different from most domestic brands’ large-scale new models every season, the color number of the new lip glaze of Colorkey Laqi every season is "almost no minefield", which shows that the products have spent a lot of thought on color selection.

In recent years, the influence of the content "planting grass" has been continuously improved. Faced with this trend, domestic beauty brands have also begun to actively use social media for "word-of-mouth communication".

Colorkey’s marketing methodology for creating explosive products in Laqi has matured: online channels become famous-sales are won by cost performance -KOL and KOC broadcast in turn to precipitate word of mouth. Every time a new product is launched, this methodology is reused to carry out "overwhelming" "planting grass" marketing, and the low threshold of new customers and new product experience brought by high cost-effective positioning is a common mode for many domestic beauty brands, including Colorkey Co., Ltd. Laqi, to harvest new customers and obtain rapid development.

This model of domestic beauty has also been recognized by capital. In 2019, domestic beauty products collectively ushered in an outbreak period, and brands from head to waist were sought after by consumers and capital.

In September last year, it received a perfect diary of $1 billion in financing led by Gaochun Capital. Recently, it received another $100 million in financing, and its valuation doubled in half a year. Emerging beauty brands such as Girlcult and Paiji have also received capital bets.

Almost all new brands of domestic beauty cosmetics have invested heavily in content platforms such as Xiaohongshu, Tik Tok and bilibili. Some brands even stopped putting SEM on traditional search platforms. However, the excessive delivery mode is having a negative impact on the brand. Open the little red book and enter the color test. Eight out of ten are similar typesetting, emoji and exclamations, with the same distorted color map of 10 grades …

Perhaps seeing the harm of over-marketing, Colorkey Laqi took a refined delivery route. Ying Shaofeng said that the company has specialized personnel responsible for different platforms and plans different delivery methods according to the platform attributes. For example, Laqi, the of Colorkey, put the word-of-mouth fission model into the little red book. Besides the head bloggers, she also attaches great importance to the cooperation with amateur bloggers.

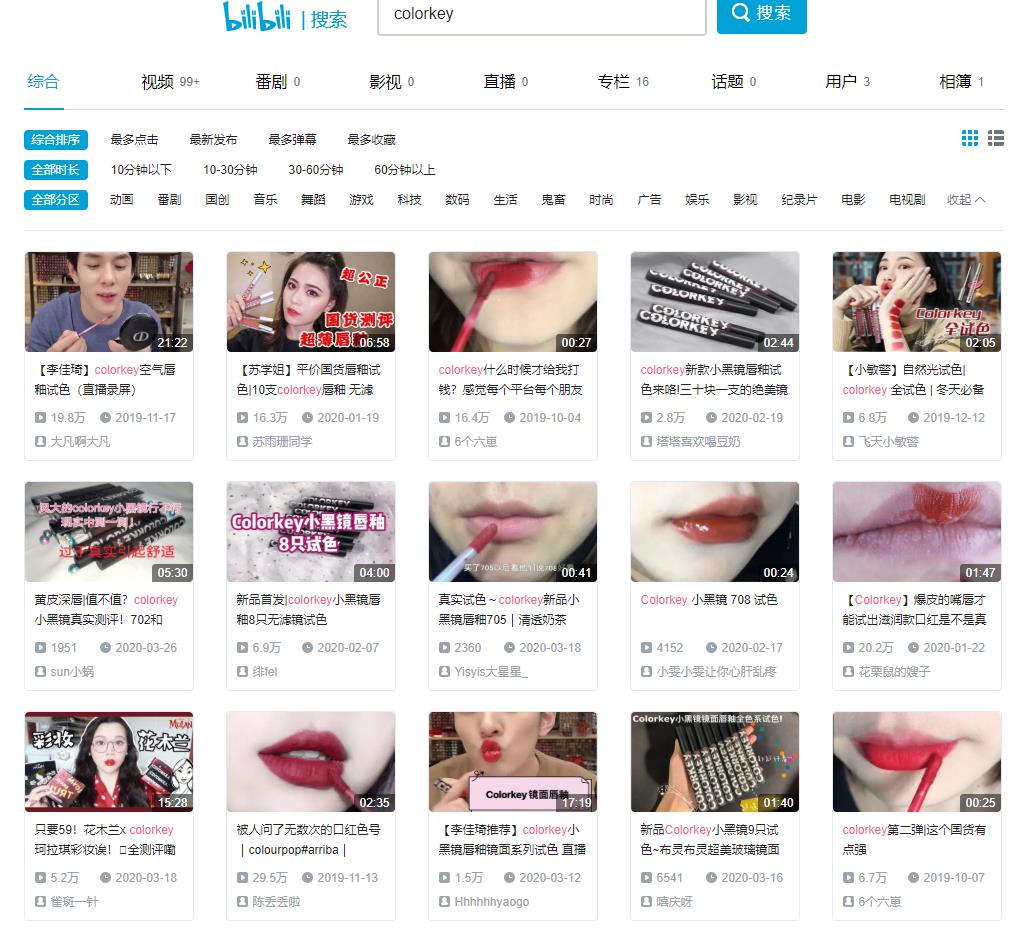

On the bilibili, Colorkey KE Laqi, relying on the agency, selected the up owners who can make colorful beauty and life, and can plant grass at medium and low prices. During the promotion process, Colorkey Laqi also constantly adjusted the material content and promotion plan according to the crowd effect, further expanding the content advantage with good data feedback effect in the first stage, and at the same time, simultaneously put in the information flow for harvesting.

Image source: Billie Billie Animation (bilibili), please enter the caption.

When online marketing and e-commerce approach saturation, offline has once again become the battlefield of domestic beauty. There are two offline modes for domestic brands: brand store and beauty makeup collection store. The typical example of the former is the perfect diary, while the latter is orange blossom, HEDONE, Zhiyouquan and so on. Colorkey Ke Laqi is also a member of the collection store.

According to Ying Shaofeng, Colorkey Laqi has set up beauty collection stores in 11 cities across the country. The cooperation between Colorkey and Laqi is not only about selling goods, but also involved in the whole store design and exposure form. Its cooperation with WOW COLOUR, a collection store, is an example. Colorkey Laqi also hopes to make use of the exhibition space of offline collection stores, play the role of brand promotion and data accumulation, and link online and offline to the greatest extent, so as to provide users with a more complete experience.

WOW COLOUR Store makes a separate display for Colorkey Laqi. Source: WOW COLOUR

In recent years, more and more domestic cutting-edge beauty brands can be purchased by Generation Z.. Hong Lei observed that the price of the domestic beauty market is increasingly close to the people, driven by domestic beauty products, and there is a downward trend.

Facing the strong competition of domestic cosmetics, multinational cosmetics groups began to try to "reduce the dimension". They aimed at young China consumers and stepped up their incubation, investment and acquisition of niche brands and cutting-edge domestic beauty brands. In April 2017, Estee Lauder acquired a 28% stake in DECIEM, the parent company of The Ordinary. In April 2018, L ‘Oreal acquired Stylenanda, the parent company of 3CE, and in October 2019, L ‘Oreal introduced NYX to the China market …

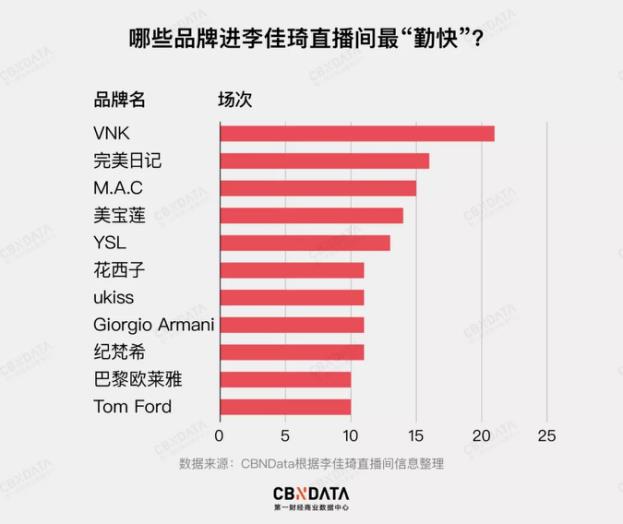

Large international companies are also embracing online channels: products that used to lie on the counters of high-end shopping malls frequently appear in the exhibition rooms of anchors of major short video platforms. According to statistics before CBNData, among the Top10 lipstick brands that cooperated with Li Jiaqi the most times, international brands occupied 7 seats.

Under the attack of international brands, domestic beauty products try to give full play to the advantages of landlords, shorten the decision-making chain, cooperate well with the supply chain, and speed up the iteration of new products.

In the supply chain, Colorkey Laqi has chosen to cooperate with Korean OEM and ODM company Kosmet. Tangduo cooperates with Shanghai Zhenchen, which has 32 assembly lines, while Girlcult chooses the cooperation mode of "big factory+many small factories". Cooperation with large factories can ensure the stability of product quality control, while small factories can realize flexible supply and try new and rare technologies.

Most of the new domestic beauty cosmetics represented by Colorkey Ke Laqi started from the explosion of a single or a small number of categories, and gained the early dividends of this marketing method, which grew rapidly.

However, with the popularity of content marketing methods and the increasingly fierce competition in the online market, there are international manufacturers before, followed by domestic competing products. How can an emerging brand like Colorkey Laqi win in the market? I believe there will be more exciting ways to play in the fierce competition.