During the Double Eleven this year, beauty care has achieved remarkable results. Now more and more young people begin to pay attention to their own image and are willing to spend time and money on their faces, which also gives us great opportunities in the beauty market. The author also used the data to re-list the trend of the beauty market for us. Let’s take a look.

In the economic downturn, "lipstick effect" is one of the most frequently mentioned keywords.

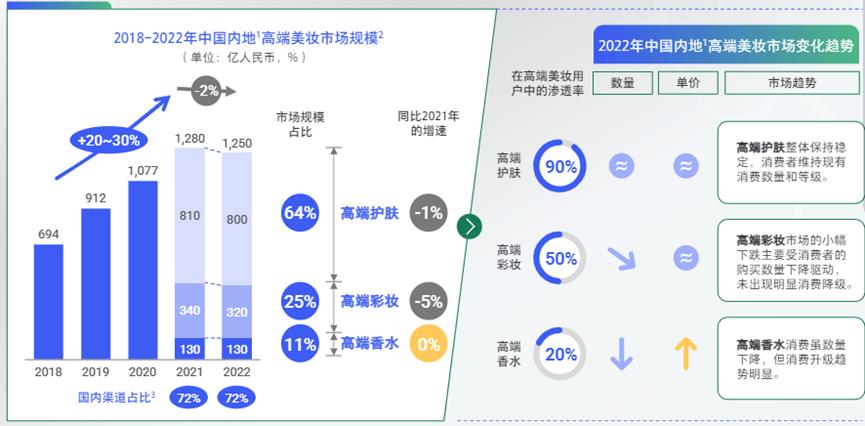

The lipstick effect is still in effect in China. According to BCG&TMI data, the domestic high-end beauty market has maintained a high growth rate of 20% in the past few years. Although there has been a slight correction of 2% this year, it is almost harmless compared with other consumer tracks that have been hit hard.

In the past Double Eleven period, the star map data showed that the GMV of beauty care reached 82.2 billion, accounting for 8% of all categories, which was also consistent with the ranking in 2021/2020.

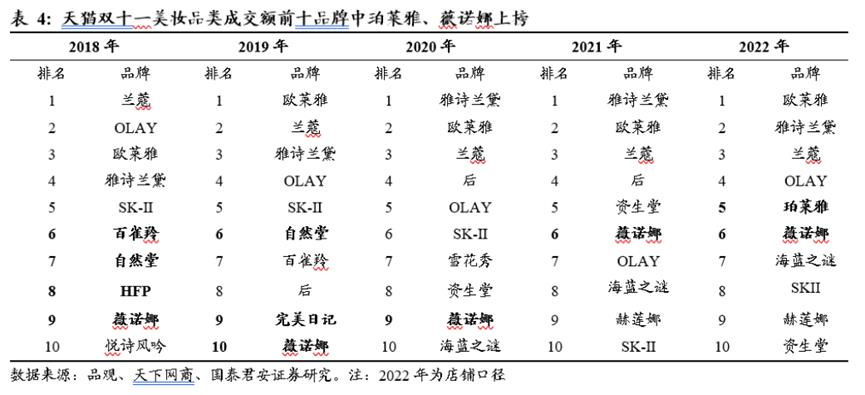

In the high-end beauty market, the status of international brands may be hard to shake for a long time. Looking at the top ten brands of Tmall’s double eleven beauty category turnover this year, only Polaiya and Winona, domestic brands, squeezed into the fifth and sixth places on the list. According to Euromonitor data, since 2019, the top three positions of high-end cosmetics market share have been firmly controlled by L ‘Oreal, Estee Lauder and LVMH. In 2021, the market share of the above brands reached 18.4%, 14.4% and 8.8% respectively.

However, the noteworthy change is that during the Double Eleven this year, most of the growth rate of international beauty brands GMV turned negative, while domestic beauty brands still maintained strong growth.

According to the magic mirror data, during the Double Eleven in 2022, the domestic beauty brand GMV reached 5.678 billion, which was only 1/3-1/4 of that of foreign brands (20.961 billion), but the domestic and foreign brands GMV of TOP50 increased by 49% and -2% respectively, continuing the trend of 618.

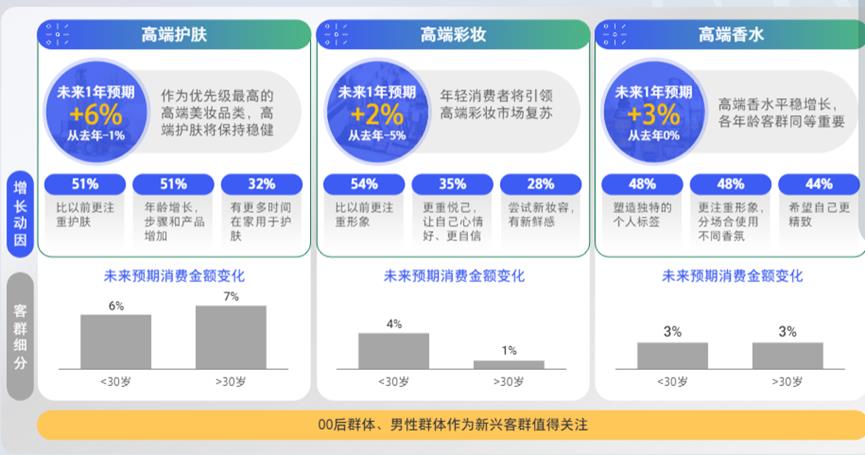

When domestic brands are constantly attacking the high-end market, the consumer/category structure of the beauty market is also changing rapidly: after 00, they begin to enter the workplace, their income is not high, and their ability to screen information is stronger; After years of market education, the demand of essence, cream, sunscreen lotion, pre-makeup lotion/toner and other sub-categories is steady, and new potential categories such as body lotion and high-end perfume are eager to compete for consumers’ attention.

How can brands capture the above trends and reach new beauty consumers with more innovative means? Recently, Tencent Marketing Insight (TMI) and Boston Consulting Group (BCG) jointly released the Insight Report on Digital Trend of High-end Beauty Market in China, and the community marketing institute picked out the dry goods to share with readers.

What is the high-end beauty market? How expensive can a product be considered high-end?

One division and reference standard given in the report is to divide the beauty market into high-end skin care, high-end makeup and high-end perfume:

- High-end perfume must surpass 500 yuan;

- In the high-end skin care sector, the price of essence/cream/eye cream products (with significant repair effect) exceeds 500-750 yuan, and the price of lotion/makeup remover/facial cleanser/mask/sunscreen/body lotion (for daily care) exceeds 200-300 yuan;

- In the high-end makeup sector, (whole face makeup) foundation/pre-makeup cream/primer/loose powder exceeds 350 yuan, (partial makeup) concealer/highlight or blush/eye shadow eyeliner mascara/eyebrow pencil exceeds 200-250 yuan, and (lip makeup) lipstick/lipstick exceeds 250 yuan.

Based on the statistics of the above categories, it is found that the high-end beauty market in China dropped slightly by 2% in 2022, mainly due to the decrease in quantity, but the purchase grade and price of products did not fluctuate obviously. Among them, the user penetration rate of high-end skin care, high-end make-up and high-end perfume reached 90%, 50% and 20% respectively. The number of high-end make-up consumers declined slightly, and the high-end perfume showed a trend of decreasing volume and increasing price.

The reason for the above trend is that the epidemic has weakened the purchasing power of a very small number of consumers under the age of 25, and their consumption in 2022 accounted for 17%, a decrease of 4 percentage points compared with last year; Secondly, light consumers are restraining their consumption, which means that customers who spend less than 3,000 yuan a year on skin care products/less than 1,500 yuan on cosmetics/less than 1,500 yuan on perfume have dropped 9%-11% on high-end beauty cosmetics. But heavy consumers of high-end beauty cosmetics (perfume costs more than 6000 yuan a year) also prefer to buy high-end perfume.

So, who is the new addition to the high-end beauty market? Male, young and sinking market are three key words that can be refined. Compared with the old and new markets in the past year, the proportion of men has increased from 16% to 20%, the number of customers under 25 has increased from 20% to 26%, and the number of third-tier and below cities has increased rapidly from 27% to 39%.

Or the awareness of image management is improving, or they are inspired by KOL/ family and friends, or they have received perfume gifts … The entry trajectory of these new customers can be summarized as follows: at first, they began to understand high-end skin care products such as facial cleanser, essence and toner, and gradually cut into high-end beauty fields such as lipstick and makeup lotion, and at the same time, they have a strong interest in body lotion, sunscreen, perfume and other emerging categories, and they are more willing to learn/share/try new products based on social platforms.

For the high-end beauty market in the future, after 00, the male customer base will gradually grow into a market force that cannot be underestimated, and the rise of new people will also bring opportunities for subdividing categories. Although there has been no obvious change in the purchase channels in the past year, online consumer contacts also require more three-dimensional, which should be further matched with offline experience.

First of all, consumers have relatively different functions and emotional demands for different categories.

- For high-end skin care products, the functional factors that consumers are most concerned about are natural ingredients, safety and non-allergy. When considering emotional factors, in addition to the brand being trustworthy, experiencing well and pleasing themselves, consumers attach great importance to the cost performance of the products.

- For high-end cosmetics, consumers are also most concerned about ingredients, brand trust and cost performance, but "durability is good", "whether it conforms to the trend of popular makeup" and "whether it can express personality" are also unique reference indicators of this category;

- For high-end perfumes, consumers will pay attention to the time of fragrance retention, and also consider the balance between fashion trends and expression of personality, but self-satisfaction is a relatively unique indicator. "First of all, you should feel good and comfortable."

Such category characteristics also form different market styles, and high-end skin care products emphasize professionalism and cost performance; The audience loyalty of high-end makeup is low, and it is more necessary to seize the market sentiment to make fashion and explosion, and to be cost-effective; High-end perfume emphasizes the recognition of brand spirit and emotional connection, so that consumers can please themselves.

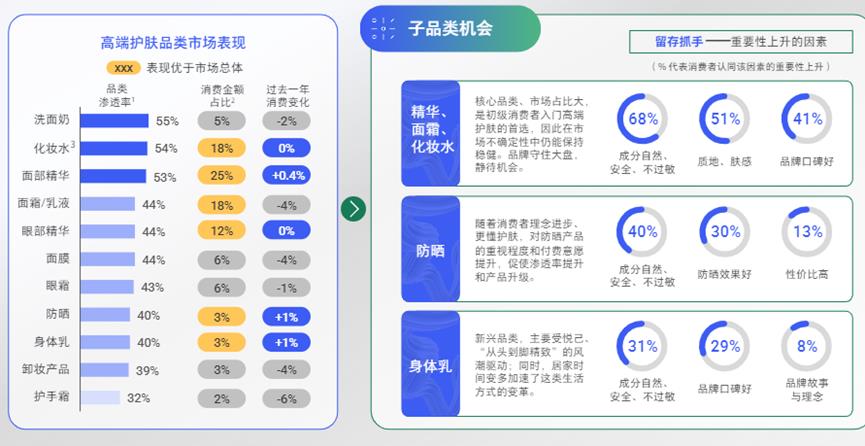

Specifically, looking at the subdivided categories, there is also a more differentiated retention grip.

In the high-end skin care market, the fastest growth of consumption in the past year is in three categories:

- The first category is the first choice of high-end skin care products for beginners, including toner, facial essence, cream/lotion and eye essence, because they are also the core categories that distinguish brand assets, and the demand is steady. The factors that consumers most agree with are natural safety and no allergy (68%), texture and skin feeling (51%) and good brand reputation (41%);

- The second category is a new potential category that appears with the growth of skin care knowledge, sunscreen products. This category is also promoted by brand and talent education, and the market demand is constantly strong. The market penetration rate (mainly the willingness to pay) and product strength still have room for improvement. What consumers most agree with is that the ingredients are naturally safe and non-allergic (40%) and the sunscreen effect is good (30%);

- The third category is the new latent category, body milk, which appears from head to toe with the exquisite makeup/home attention. Because this category is mainly driven by self-esteem and new lifestyle, it needs a good reputation (29%).

Generally speaking, due to the outstanding functional attributes of high-end skin care products, the premium ability is significantly higher than that of high-end cosmetics, and there are many core categories with stable demand, and it is necessary to narrow the distance with consumers in all directions through discounts/sample trials/brand services (such as Spa appointment, product use teaching, online skin diagnosis, etc.).

In the high-end make-up market, the categories with the fastest growth in sales in the past year include two categories:

- The first category is a new category driven by new makeup methods (mask makeup/eye makeup), including eye shadow/eyeliner and eyebrow products. Consumers in this category most agree with whether the products conform to the fashion trend (32%), novelty (23%) and limited quantity (22%).

- The second category is the category driven by advanced makeup knowledge, such as pre-makeup milk/primer, loose powder and concealer; Consumers not only care about the ingredients of this category (34%), but also pay special attention to professionalism (29%) and novelty (15%);

- In addition, lipstick and foundation are still the pillar categories of makeup (over 60%), and consumers are most concerned about ingredients (35%), which do not smudge/touch cups/float powder (21%) and have good durability (18%).

Generally speaking, consumers’ emotional demands for high-end cosmetics are stronger, so their decision-making is faster. Whether the brand can shorten the consumer’s consumption link from planting grass to placing orders by means of a series of marketing combination punches, such as star advertisements, product stories, product trials, discounts and exquisite packaging, is the key to efficient transformation, among which star advertisements have the most remarkable driving effect.

In the high-end perfume market, in the past year, more consumers used perfume for private parties/dates (73%) and business/office (57%). Flower and fruit notes, exotic notes, wood notes, green leaves notes and aquatic notes are the most mainstream fragrance types, but their preferences are different in different scenes.

For example, exotic fragrance and floral fragrance that can express special emotions at private parties are more popular; In the business scene, the more moderate woody notes are very popular; When outdoors or at home, except for the flowers and fruits, almost all other fragrance types can be tied.

Perfume itself is an emotional commodity, and the market cultivation of high-end perfume is at an early stage. Evaluating the success of a high-end perfume depends more on whether the brand can make consumers feel longing and psychological ripples for love and even more beautiful stories after putting out some product value points such as niche unique fragrance, exquisite and attractive packaging and well-connected brand stories.

In the past year, the categories with strong growth in the high-end beauty market showed the following characteristics:

- Consumers’ knowledge of skin care/makeup is more advanced, and they show stronger demand for products such as sunscreen/pre-makeup milk/foundation; The body management pursued by consumers is further subdivided, and the skin care/makeup is fully refined, which has a clearer aesthetic appeal for eyes/eyebrows/whole body skin;

- With the advancement of existing customers, "after 00, men, sinking market" also constitutes a new army of high-end beauty consumers, who either cut into high-end makeup from high-end skin care, or were given new varieties of grass in human gifts …

Expensive price is not equal to high-end, so is the high-end beauty market. High-end skin care products, high-end cosmetics and high-end perfumes also have very different strategies in order to fill the lining of their products and make consumers feel value for money.

High-end skin care products have outstanding functional attributes, and it is more necessary for consumers to experience and try the products at low cost through professionalism (such as ingredients, technology and patents) and cost performance; As a more emotional category, high-end cosmetics need to explore new explosions with stability, and high-end perfumes need to tell a three-dimensional moving product and brand story …

What are the experience of establishing contacts for different categories? What are the decision-making characteristics of the new customer base? How to optimize the reach of new customers? How to consider the cooperation of online and offline contacts? The above questions will be presented in the next article.

Source WeChat official account: Community Marketing Research Institute (ID: community _ marketing), insight into community consumption.

This article is authorized by Cooperative Media @ Community Marketing Research Institute, where everyone is a product manager. It is forbidden to reprint without permission.

The title map comes from Unsplash and is based on CC0 protocol.

This article only represents the author himself, and everyone is a product manager. The platform only provides information storage space services.