[Autohome Guangzhou Discount Promotion Channel] Good news, an unprecedented promotion is underway in Guangzhou. In order to meet consumers’ expectations for high-performance luxury SUVs, Mercedes-Benz has officially brought generous discounts of up to 130,000 to the Guangzhou market. The original price of the Mercedes-Benz GLE coupe AMG started at 1.0408 million, and now the minimum starting price has been reduced to a more attractive range. If you are interested in this dynamic luxury car, now is the rare opportunity to seize this rare opportunity and click "Chatti Car Price" in the quotation form to get higher discounts and start your driving journey.

The Mercedes-Benz GLE coupe AMG, with its unique design and dynamic lines, shows the perfect fusion of luxury and performance. On the front face, the embedded air intake grille of the AMG logo highlights family strength and exquisite craftsmanship, and with the sharp LED headlight set, it exudes a strong visual impact. On the side of the body, the back-mounted shape gives it an incomparable sense of elegance and speed, and the streamlined silhouette and sculptural lines work together to create a harmonious coexistence of power and aesthetics. In terms of overall style, the Mercedes-Benz GLE coupe AMG blends classic and modern, showing an unparalleled sense of sports luxury.

With its streamlined body design, the Mercedes-Benz GLE Coupe AMG outlines an elegant and dynamic side profile. Its body size is 4944mm*2018mm*1716mm and the wheelbase reaches 2935mm, showing a spacious and coordinated space layout. The side lines are smooth and dynamic, and the combination with the front wheel size 275/45 R21 and the rear wheel size 315/40 R21 wheels not only enhances the dynamic performance of the vehicle, but also gives it a unique visual impact. The overall design fully reflects the sports gene and luxury texture of the AMG brand.

The interior design of the Mercedes-Benz GLE Coupe AMG is full of luxury and sportiness. The exquisite Nappa leather material wraps the seat for ultimate comfort. The seat supports front and rear adjustment, backrest adjustment and multi-directional electric adjustment, including leg support and waist massage function, to ensure the comfort of long-distance driving. The steering wheel is made of genuine leather and carbon fiber/flip fur for excellent grip, and has electric up and down + front and rear adjustment functions, which is convenient for the driver to personalize. Central 12.3-inch high definition touch screen, integrated multimedia system, navigation and phone functions, easy to operate with automatic speech recognition. In addition, the car is also equipped with USB and USB/Type-C ports, including mobile phone wireless charging function, providing passengers with convenient electronic device connection and charging needs. Whether it is the driver’s driving experience or the daily needs of passengers, Mercedes-Benz GLE coupe AMG shows its meticulous interior design and configuration.

The Mercedes-Benz GLE Coupe AMG is equipped with a powerful 3.0T turbocharged engine, which can reach a maximum power of 320 kilowatts and release 435 horsepower. The torque output of this engine is also considerable, providing 560 Nm of torque support for the vehicle. With a 9-speed automatic transmission, the driver can easily switch driving modes and enjoy a smooth driving experience.

In summarizing this article about the price reduction promotion of Mercedes-Benz GLE Coupe AMG, we have to mention this highly attractive promotion strategy. In order to give back to the love and support of the majority of consumers for the AMG brand, Mercedes-Benz has decided to offer a limited-time discount for the GLE Coupe AMG. This move not only makes the models with equal performance and luxury more cost-effective, but also provides a great opportunity for potential car owners to start. Seize this opportunity, you can not only have the excellent craftsmanship of Mercedes-Benz, but also experience the ultimate driving pleasure brought by AMG. Such a sincere promotion is not to be missed. Take action now and make Mercedes-Benz GLE Coupe AMG a part of your life!

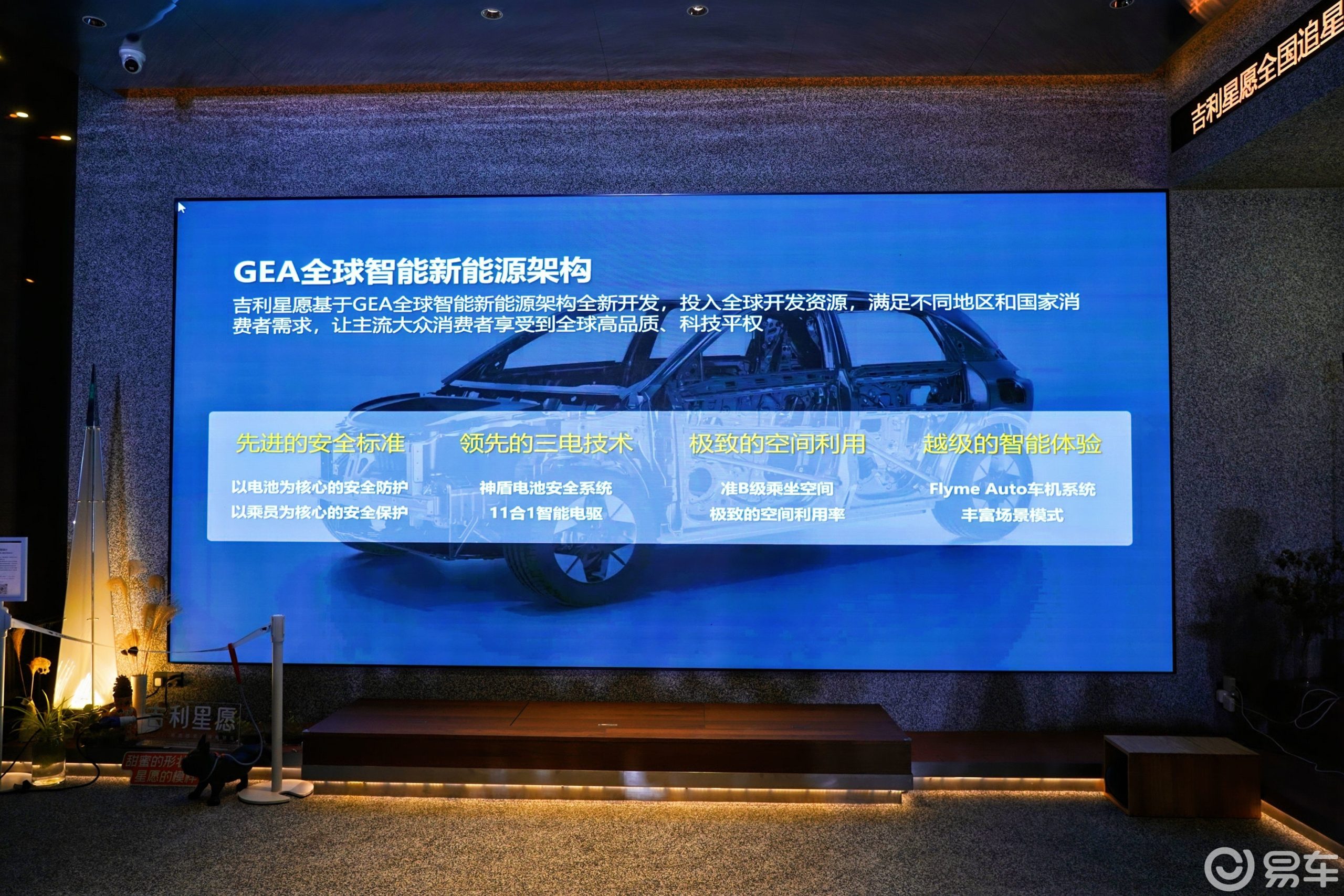

Based on GEA’s new energy architecture, Geely Star is positioned as a "new smart pure electric car", which has a bright performance in power control, safety and intelligence. The new car has launched five models with a pre-sale price range of 7.88-10 7,800 yuan. With its high cost performance and rich configuration, it has attracted a lot of attention.

Based on GEA’s new energy architecture, Geely Star is positioned as a "new smart pure electric car", which has a bright performance in power control, safety and intelligence. The new car has launched five models with a pre-sale price range of 7.88-10 7,800 yuan. With its high cost performance and rich configuration, it has attracted a lot of attention. In terms of driving control, Geely Xingyuan is the only pure electric car in its class with a layout. With independent front and rear suspension systems, it not only improves driving efficiency and acceleration performance, but also brings a more stable handling experience. Coupled with a minimum turning radius of only 4.95 meters, the driving control performance of this A0 pure electric car has reached a new height, providing driving pleasure comparable to high-end performance cars.

In terms of driving control, Geely Xingyuan is the only pure electric car in its class with a layout. With independent front and rear suspension systems, it not only improves driving efficiency and acceleration performance, but also brings a more stable handling experience. Coupled with a minimum turning radius of only 4.95 meters, the driving control performance of this A0 pure electric car has reached a new height, providing driving pleasure comparable to high-end performance cars.

In terms of intelligent configuration, Geely Star Wish is also not to be underestimated. Equipped with Geely’s self-developed Flyme Auto smart cockpit system, it supports Flyme Link handcar interconnection, wireless charging, and Hicar and Carlink functions, achieving a seamless connection between mobile phones and cars, bringing a smooth experience. The dual-zone automatic speech recognition function makes the operation more convenient and enhances the convenience and fun of using the car.

In terms of intelligent configuration, Geely Star Wish is also not to be underestimated. Equipped with Geely’s self-developed Flyme Auto smart cockpit system, it supports Flyme Link handcar interconnection, wireless charging, and Hicar and Carlink functions, achieving a seamless connection between mobile phones and cars, bringing a smooth experience. The dual-zone automatic speech recognition function makes the operation more convenient and enhances the convenience and fun of using the car.

The release of Geely Star Wish not only brings stylish, safe and intelligent new travel options to consumers in Tianjin, but also demonstrates Geely’s strength in the field of new energy. With its excellent design, flexible space and cutting-edge intelligent technology, Star Wish will redefine the A0 pure electric car market and is bound to set off a new round of enthusiasm after its listing.

The release of Geely Star Wish not only brings stylish, safe and intelligent new travel options to consumers in Tianjin, but also demonstrates Geely’s strength in the field of new energy. With its excellent design, flexible space and cutting-edge intelligent technology, Star Wish will redefine the A0 pure electric car market and is bound to set off a new round of enthusiasm after its listing.