Cctv news: (Reporter: Liu Qi Yu Xiaodan) One hour, 312 movements without interruption.

This is the limit of Pepe’s recent single exercise in the gym.

After three years of success, she lost 20 pounds of meat, tightened her body and had a good appearance, which made her accumulate more than 100,000 fans on the social platform just by punching in the gym every day.

In the East Fifth Ring Road in Chaoyang District, Beijing, the intersection is crowded, and young people holding leaflets can be seen from time to time. They silently look at the men and women in the past, and occasionally step up and say, "What about swimming and fitness?"

Pepe often receives such leaflets. It takes 10 minutes to drive from Pepe to the gym, and there are at least three health clubs belonging to different brands along the way.

In order to help college students lose weight scientifically, Nanjing Agricultural University has offered a "fat reduction course" for many years. The picture is the Xinhua News Agency data map.

According to commercial survey data, during the fifteen years from 2002 to 2017, the overweight rate and obesity rate in China increased by about 17% and 11% respectively, making it the country with the largest number of obese people.

At the same time, as of 2018, there are more than 46,000 fitness clubs and private training studios in China, the number of which is equal to that of the United States, a big fitness country.

"I don’t lose weight in May, but I’m sad in June" and "After 25, all the fine lines grow downward". In June, the once seasonal panic turned into the inspirational capital of many "iron-clad people" — — "Some people are out of shape for a year, and some people are out of shape for a lifetime."

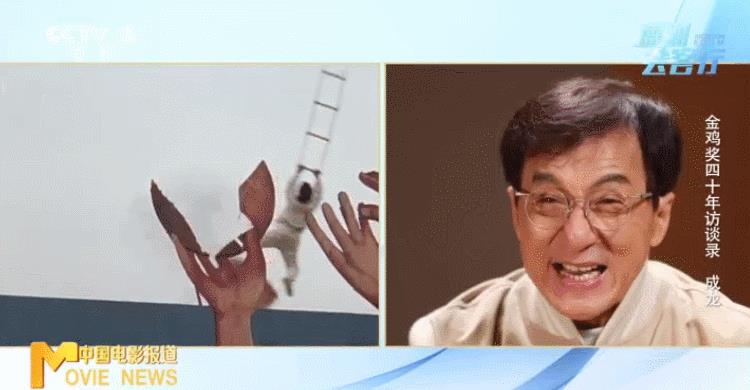

Recently, CCTV reporters walked into gymnasiums and gymnasiums in Beijing, approached the starting point of the transformation of "iron-pulling" girls, and looked for the life password of changing "shape" into "heart-walking".

Enter the line | counter the critical strike of negative energy

In an industry survey of 5851 members from 230 cities in China released in 2018, losing weight, shaping the body and relieving stress ranked among the top three fitness motivations.

"More than half of our annual members are new members." A gym in Haidian District, Beijing, said, "The first purpose of many members is not to lose weight, but it doesn’t mean that they don’t care."

Pepe fitness for 3 years.

"When I was 130 kg, my eyes narrowed into a crack. Slimming down now is really cosmetic. "

In 2015, Pei wore an eight-month-old baby to the hospital for a physical examination, and the child’s height and weight did not reach the standard value. "Proper exercise, improving physical vitality and metabolic rate, is helpful to increase milk quantity." Because of a doctor’s advice, Pepe began to contact fitness.

She returned to her hometown in Guangxi from Beijing and studied with the help of a friend who runs a gym. In order to support her daughter, my mother spent three months with her grandson in Guangxi.

Later, Pepe’s milk volume really came up and she became addicted to fitness. She was surprised by the "side effect" of getting smaller waist and thinner legs and getting better figure.

Among the new members every year, novice mothers who are out of shape and oppressed by the life of bringing a baby after childbirth account for a large proportion. Pepe resonates with this.

Pepe is eating a moon meal after giving birth.

She is the kind of girl who grew up beautiful and wanted to enter the entertainment industry. "I love my children very much, but when life is all about breastfeeding and taking care of children, I feel that life is chaotic, and the sense of oppression will swallow me up. But in the gym, I am myself. "

Pepe gave CCTV reporters a set of data on leg strength training movements:

30 (pieces) * 3 (group) lunges, 12 (pieces) * 3 (group)+15 (pieces) * 2 (group), 12 (pieces) * 4 (group) gluteal bridge and 12 (pieces) * 3 (group) full squats.

At the end of the practice, my brain went blank and tears flowed out uncontrollably. "There are no shortcuts to fitness and weight loss, and they are all practiced bit by bit."

Pepe’s fitness process animation, information provided by myself.

Pepe told the CCTV reporter that she would use the "spiritual victory method" to paralyze herself and complete the hard training. "Self-discipline and freedom" coexist, which is the driving force for her to persist. "It’s still a little flat here, which is the only place I’m not satisfied with!" Pepe leaned forward playfully and patted her hips.

On the Tik Tok, Pepe insisted on recording his fitness changes and doing some popular science, which has accumulated 168,000 fans. Some people commented that Gai Lou praised her as an "inspirational goddess", while others criticized her for "being rich and being able to take private lessons".

"Compared with private education, personal efforts and self-discipline are the key. Private education with money is only a favorable condition, and people themselves are the key." Pepe often patiently explains to netizens who privately believe in her: "In fact, no matter what kind of exercise, as long as you persist and accumulate slowly, you will definitely open the gap with those who don’t exercise. So whether it’s iron rolling, yoga or other sports, as long as you like it, it will definitely pay off. "

For those who ignore personal efforts and say that "only those who have money can be thin by private education", she will reply directly, "It’s still sour and worthless if you don’t work hard".

Counter-attack | 120 kg of meat in 9 months

Xun Chao, who is determined to lose weight and keep fit, has a much more painful training experience.

Height 167 cm, weight 233 kg. Because of her fat, this enthusiastic Tianjin girl hardly takes pictures and wears only black clothes.

Because of his easy-to-fat constitution and lack of self-discipline, Xun Chao went from chubby to big. Always found in the crowd, "accustomed to the ridicule and eyes around."

"Dragging more than 200 kilograms of body on a bicycle, it is particularly difficult to lift your feet every time. The joints have to bear weight and there is fat. When you step on it for 20 minutes, your brain begins to lack oxygen. "

Pain, suffocation and nausea, Xun Chao’s initial fitness experience was terrible.

Xunchao’s exercise process is animated, and the information is provided by myself.

Why insist? Xun Chao said that she made up her mind to lose weight because "health" has become an unbearable weight in her life.

"Obesity will be accompanied by various diseases. I had pregnancy-induced hypertension when I gave birth." When she was eight months pregnant, the fetus stopped growing in her stomach, and the doctor gave her a critical notice. "The fetus is not yet full-term, and the doctor advised me to cut it out. I finally took the risk and waited for 38 weeks, and I did general anesthesia surgery on the same day. "

Later, after physical examination, he was diagnosed with severe fatty liver. As the children grow up day by day, Xun Chao feels that his body is getting older faster than his age. "I have reached a young age in the world, and my body can’t collapse."

When he found that his son’s 7-year-old weight had reached 80 pounds, Xun Chao made up his mind that "losing weight can’t wait any longer, and he must set an example for his son!"

Xunchao Fitness for One Year

In the diet of bodybuilders, there is usually a "cheat meal" every week, so you can eat whatever you want to avoid the collapse of fasting for too long. Xun Chao wrote down the daily weight changes in the notebook, and when she met the entertainment that could not be pushed away, she also recorded it and punished herself for canceling the "cheating meal" that week.

Gradually reduce the number of "eating out" with friends, to form a regular routine of going to bed early and getting up early, and then to keep your mouth shut and spread your legs … … When exercise becomes a habit like eating and sleeping, the results it brings become less and less important.

"My goal this year is that I don’t want to lose weight any more. Why should I lose less than 100? I don’t want to be a beauty pageant, just be healthy." Xun Chao also wants to learn freestyle and butterfly and try to run a marathon.

Xun Chao began to take his son to run outdoors every day. "I want to prove to him that my mother can lose weight and so can he. No difficulty can be overcome. "

Alternative | Find a way to "get tired of playing"

Before being interviewed by CCTV reporters, Tong Tong had just returned from a trip to the Philippines. In 9 days, I played deep diving, zip line, ATV four-wheel drive cross-country, diving and various extreme sports. "The biggest purpose of my fitness is not to get tired of playing."

Tong Tong dives in the Philippines, and the information is provided by myself.

Five years ago, Tong Tong was a 9-to-5 office worker. At that time, she felt that her physical fitness was declining year by year, and she was panting when chasing buses. Later, she gave up this modest life and became a freelancer, opening a flower shop with her friends in Sanlitun.

"I don’t want to live in a daze with a big belly and eating sea plugs every day. I still want to go out to play, plus I love to boast. " Two and a half years ago, she began to try to lose weight while keeping fit.

The process of losing weight is also a process of "trial and error".

"Good food and laziness are natural enemies on the road to losing weight", and Tong Tong began to lose weight by dieting. Have a little breakfast every morning, an apple at noon and no food after noon. "Later, everyone was a little depressed, so they lost their hair and became irritable." Dieting ended in failure.

After that, she tried acupuncture, massage and eating meal replacement products … … "There is something wrong with the body, amenorrhea for three months, take medicine to eat back. I haven’t done that since then. Losing weight should not be based on hurting your body. After all, health is the premise of beauty. " Tong Tong came to the conclusion that it still depends on "moving".

Once a week, climb Xiangshan "zipper" to practice leg strength. When she was busy at work during the day, Tong Tong used her evening time to go. Three times a week in the gym, I practiced muscle, strength and aerobics, learned hundreds of movements and challenged dozens of instruments. It took nearly two years for Tong Tong to do four pull-ups at a time.

"I can’t accept that my body is going downhill, so I have to go." Talking about "persistence" with CCTV reporters, Tong Tong said that even though she sprained her waist because of hard pulling and lay at home in pain for a week, she never thought about giving up.

"I actually didn’t weigh much when I pulled it hard, that is, I couldn’t hold my hand. I wanted to put it on the ground and pick it up again. I didn’t pay attention to my posture and hurt my waist when I dropped it." During that time, Tong Tong was in a hurry. She was afraid that if she didn’t practice for a long time, her strength and heart and lungs would return to the original, and everything would have to start again. "If you want to start again, there is a foundation ahead, and you will definitely recover quickly."

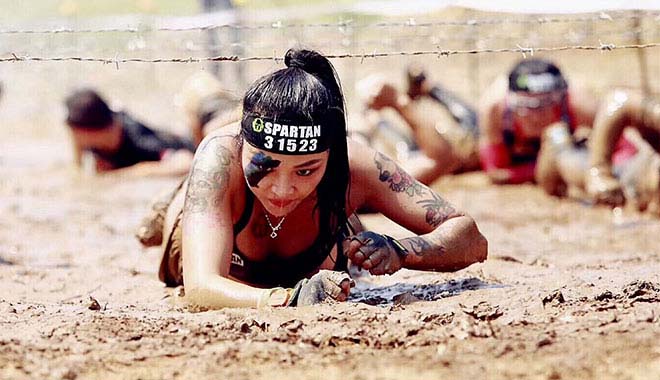

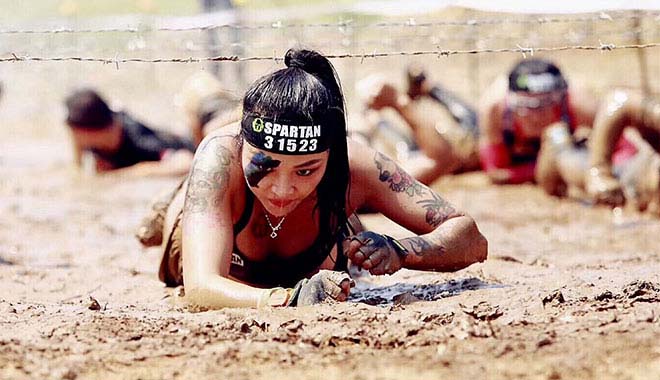

Tong Tong participated in the Beast Race. The picture shows the scene of the competition.

In 2016, the Spartan Warriors Tournament landed in China. This world-class series of obstacle races consists of three levels of regular events, with the track length ranging from 6 km to 21 km and the number of obstacles ranging from 20 to 30. In 2018, after completing all levels of competitions and winning the 21-kilometer obstacle course of the Spartan Warriors and Beasts, Tong Tong successfully won the "Tri-color Badge" medal.

Tongtong Fitness for 2 Years

Fitness for two and a half years, only from the weight point of view, Tong Tong’s weight of 56kg has not changed. "But my body shape is different now, people are more energetic and my body is growing backwards."

Exercise your body and mind to the limit (spartans push their minds and bodies to their limits) & mdash; — This is the creed of Sparta Warriors, and it is also the driving force that Tong Tong insists on.

Statistics show that among those who "scream" to lose weight, the proportion of women is as high as 84.29%, and that of men is only 15.71%.

Compared with men, women seem to be more willing to share their feelings and daily life on social networks, but they may not be able to do so in execution.

Zou Chang is a personal fitness teacher. After graduating from Beijing Sport University, he obtained a fitness license and served in three fitness clubs in five years.

He observed that there are two kinds of people who are the easiest to persist, one is that they can get results in the early stage, and the other is middle-aged people. "When people reach middle age, their sense of crisis is relatively heavy, and their time and money are relatively free to control."

In recent years, a wind blowing from celebrity social networks and gyms has opened a new face of public aesthetics. "Thin is no longer beautiful, and vest line and sense of strength have replaced chopsticks legs."

He once took a student in Wudaokou, Beijing: because he became fat and lovelorn, he made up his mind to lose weight and lost 60 pounds. Now he still insists on training. The girl thanked him and said that fitness not only made her healthy, but also helped her regain her self-confidence.

While speaking, two girls walked into the store arm in arm. Zou Chang said goodbye to the reporter in a hurry: "Sorry, I have to go, new member."