In 1992, Chen Jinfei, a real estate investor in Beijing, was invited to a dinner party. It was this dinner that allowed Chen Jinfei to meet Liu Yifei, which changed the fate of Liu Yifei’s mother and daughter.

However, at that time, Liu Yifei was not called Liu Yifei, but Liu Qian Meizi. Because her parents had divorced since childhood, Liu Qian Meizi changed her surname to Liu with her mother Liu Xiaoli, and the mother and daughter depended on each other for survival.

Liu Xiaoli and Chen Jinfei are old acquaintances. The two used to study in the same school, so they are considered "old classmates".

When she was young, Liu Xiaoli was the school beauty in the school, and there was an endless stream of suitors around her. Back then, the poor boy Chen Jinfei also had a crush on her, but it was limited to "secret love".

Ten years in Hedong and ten years in Hexi, the two never imagined that they would meet again many years later, and it would be like this.

The little-known poor boy Chen Jinfei has become a super rich businessperson by doing export textile business and investing in real estate.

And Muse Liu Xiaoli, who was sought after by everyone, experienced marriage and birth, and then divorced, living alone with her daughter Liu Qian Meizi, but her life was not satisfactory.

Both of them have added a lot of life experience and become mature and stable. The only thing that has not changed is that Liu Xiaoli is still so beautiful.

Although Liu Xiaoli is already 33 years old and has had a baby and been divorced, she is still as beautiful as she used to be and has a hint of the charm of a mature woman.

Chen Jinfei greeted Liu Xiaoli warmly, and the two chatted and laughed, talking about their experiences over the years and the current situation.

While chatting, Chen Jinfei saw Liu Qian Meizi, who was taciturn on the side. Perhaps it was because her parents divorced and did not have her father by her side since she was a child. Liu Qian Meizi was more afraid of life and timid, and did not like to talk much.

However, Liu Qian Meizi perfectly inherited the good genes of her mother, Liu Xiaoli, and was beautiful and cute, just like an exquisite doll.

When Chen Jinfei saw Liu Qian’s beauty, he couldn’t help but praise that the girl doll was so beautiful, and joked, "If only I had such a daughter."

Perhaps it was Liu Qian Meizi, who lacked fatherly love since childhood, who felt Chen Jinfei’s love and enthusiasm.

After she heard Chen Jinfei’s words, she suddenly jumped off the stool and walked over to Chen Jinfei and called him "Dad".

It was also from this time that Chen Jinfei recognized Liu Qianmeizi as a "goddaughter", and the fate between him and Liu’s mother and daughter was officially opened.

Ever since he recognized Liu Qian Meizi as his goddaughter, Chen Jinfei and Liu Xiaoli had more contact. He was very attentive to the mother and daughter, and he often gave gifts to the mother and daughter.

If she hadn’t left Beijing for business reasons, I’m afraid Liu Xiaoli would have married Chen Jinfei instead of a Chinese-American.

Soon after, Chen Jinfei’s business abroad expanded rapidly. He needed to go abroad to negotiate business, and his work focus also shifted to foreign countries. Due to his busy work, he had less contact with Liu Xiaoli’s mother and daughter when they were far away.

Although she didn’t have Chen Jinfei’s care, Liu Xiaoli was also very sober and powerful. With her beauty and business acumen, she made a lot of money and had the idea of moving abroad.

In 1997, Liu Xiaoli moved to the United States with her 10-year-old daughter, Liu Qian Meizi, for work and education reasons.

When living in the United States, Liu Xiaoli met a lawyer who was Chinese-American. She also did a small business on weekdays and had very good economic conditions. The two met each other and quickly fell in love.

After Liu Xiaoli dated the Chinese-American lawyer for a period of time, the two entered the marriage hall, and Liu Xiaoli and Liu Qian Meizi became American citizens.

Liu Xiaoli spent a happy time with the Chinese-American, and Liu Qian Meizi also briefly felt the care of her father. Unfortunately, the good times did not last long, and Chen Jinfei’s appearance disrupted the peaceful life of the mother and daughter.

In 2000, Chen Jinfei broke through the 2 billion, perennial in the Forbes list of the top 20, his business also expanded to the United States, during that time Chen Jinfei often flew to the United States to talk about business.

Chen Jinfei learned that Liu Xiaoli’s mother and daughter were also in the United States. During his business trip, he contacted Liu Xiaoli and went to visit the mother and daughter with gifts.

At this time, Chen Jinfei had not seen Liu’s mother and daughter for seven or eight years. The last time she saw her goddaughter Liu Qian Meizi, she was only five years old.

Today, Liu Qian Meizi is already thirteen years old and has a graceful appearance, while Liu Xiaoli is also over forty years old and has become a lot more mature.

When we met again, Chen Jinfei had mixed feelings. I don’t know if it was out of kindness and wanted to fulfill his duty as a godfather, or if he was attracted by the beauty of the mother and daughter, Chen Jinfei took good care of Liu’s mother and daughter, and explained that if Liu Xiaoli needed anything, he would tell him that he would definitely go through fire and water.

In the days to come, as long as Chen Jinfei goes to the United States for business or has time, he will definitely visit Liu’s mother and daughter, enjoying it rain or shine.

In 2002, Liu Xiaoli and her Chinese-American husband broke up and divorced. As for the reasons for the divorce, there are different opinions. Some say it is because of Chen Jinfei’s "interference", and some say that the two sides have different personalities and habits, and the contradiction is prominent.

After the divorce, Liu Xiaoli was a little confused and torn. She didn’t know whether to continue to stay in the United States or listen to Chen Jinfei’s words and bring her daughter Liu Qian Meizi back to China for development.

At that time, Liu Qian Meizi was 15 years old and had her own opinions and ideas. She wanted to become an excellent actress like her idol, Vivien Leigh, and hoped to return to China to pursue her acting dream.

And Chen Jinfei also supported his goddaughter Liu Qian Meizi to pursue her dream, and helped persuade Liu Xiaoli to return to China for development. He has many luxury houses in China, so don’t worry about living and living. Everyone is "family".

Seeing her daughter’s enthusiasm and Chen Jinfei’s promise to take good care of their mother and daughter, Liu Xiaoli decided to return to China for development. In this way, Liu Qian Meizi followed her mother Liu Xiaoli and godfather Chen Jinfei back to China.

Chen Jinfei did indeed live up to his word. He gave Liu’s mother and daughter a very superior material life, and with a wave of his hand, the mother and daughter lived in a grand mansion in Beijing, with a total area comparable to four football fields.

In the mansion, all kinds of facilities are available, including entertainment and leisure facilities. In addition, we also specially built a dance practice room and piano room for Liu Qian Meizi to cultivate her talents and prepare for entering the entertainment industry.

In order to take better care of the mother and daughter, and afraid that the mother and daughter would be bored, Chen Jinfei not only hired many drivers, bodyguards and servants, but also raised seven large hounds to accompany and protect them. These hounds were Liu Qian and Meizi’s best playmates.

Interestingly, after Chen Jinfei fell in love with Yang Caiyu and abandoned Liu’s mother and daughter, the mistress of these hounds became Yang Caiyu. It seems that "feng shui turns", but that’s all for later.

In those years, Chen Jinfei could always be seen accompanying Liu’s mother and daughter, accompanying them to eat, go shopping, and play.

The three were inseparable and glued together. Maybe the relationship was too "intimate", and the three even had a "love triangle". In the face of all kinds of rumors and rumors, Chen Jinfei and Liu’s mother and daughter were "deaf" at first.

As public opinion grew louder, Chen Jinfei announced to the public that he was Liu Qian Meizi’s "godfather" (godfather in American terms), and said that he was good to his goddaughter and her mother, which was a matter of course.

In addition to material satisfaction and life companionship, even in the future, Chen Jinfei is also dedicated to helping Liu Qian and Meizi.

Chen Jinfei first recruited an expert to change the name of his goddaughter Liu Qian Meizi, and then helped her successfully enter the Beijing Film Academy.

In 2002, 15-year-old Liu Qian Meizi changed her name to "Liu Yifei" with the help of her godfather, and was admitted to the Beijing Film Academy as a Chinese-American, becoming the youngest "international student" in Beiying.

Chen Jinfei used his banknote ability to buy an apartment on a plot of land in Beijing’s Second Ring Road. He named the apartment "Jinfei" apartment, and the name was self-evident.

Then, Chen Jinfei asked his daughter Liu Yifei to be the spokesperson of "Jinfei Apartment", promoting her, and printing a large number of photos and posters.

After Chen Jinfei’s operation and packaging, Liu Yifei received some advertising shots, and with her outstanding beauty and invincible temperament, she was soon appreciated by the director of "Golden Dust Family".

In 2002, director You Jianming was preparing to film "Golden Dust Family". He chose Chen Kun to play the male lead, Jin Yanxi, and Dong Jie to play the female lead, Leng Qingqiu. The candidate for the female lead, Bai Xiuzhu, has not been decided yet.

When you Jianming was worried about the role of Bai Xiuzhu, he accidentally saw the advertisements and promotional posters shot by Liu Yifei, and immediately felt that his eyes were bright, and he immediately threw an olive branch to Liu Yifei.

Liu Yifei was originally going to enter the entertainment industry, but when she saw an invitation from a director, she agreed without saying a word. As a result, after the broadcast of "Golden Dust Family", it became popular all over the country, and the smart and beautiful Liu Yifei also began to emerge.

"Bai Xiuzhu" let everyone know Liu Yifei, and what really made Liu Yifei popular was the image of "fairy sister".

"The Eight Dragons", "The Legend of the Immortal Sword" and "The Condor Heroes" are Liu Yifei’s classic masterpieces. Whether it is Wang Yuyan, Zhao Linger or the little dragon girl, Liu Yifei plays vividly, with both appearance and acting skills.

These three dramas have given Liu Yifei a firm foothold in the entertainment industry, and her image of "fairy sister" has also been deeply rooted in the hearts of the people, making her a hot actress.

In 2005, "Good Godfather" Chen Jinfei did two great things for his goddaughter Liu Yifei.

The first thing was to establish the "Red Star Dock" company and praise Liu Yifei. It is worth mentioning that there is only one artist in this company, Liu Yifei, which means that the whole company serves her alone, and Liu Yifei has thousands of pets.

The second thing Chen Jinfei did for Liu Yifei was to hold a super luxurious coming-of-age ceremony for her, allowing her to shine in the audience and fulfill her dream of being a princess.

August 25, 2005, is Liu Yifei’s 18th birthday, in order to help his daughter celebrate the birthday, Chen Jinfei a week in advance, spent 1.80 million in the state banquet-level hotel for Liu Yifei 18 years old adult ceremony.

On that day, in addition to the cultural and business bosses, there were also many big names in the circle, such as Zhang Jizhong, Zhu Shimao, Huang Xiaoming, Zhang Min, Lin Zhiying and others, who arrived to congratulate. The scene was huge and lively. Liu Yifei could say that she had the limelight.

Under the escort of her godfather Chen Jinfei, Liu Yifei grew up smoothly, and no one dared to provoke her. Her acting career was also booming all the way.

Liu Yifei even entered the film industry and made movies, such as "Love Notice", "A Ghost Girl", "Legend of Hongmen Banquet", "Four Famous Shops", etc. Unfortunately, these movies did not go well at the box office. Liu Yifei was once criticized in the film industry as "box office poison".

However, what Chen Jinfei never expected was that the "goddaughter" he had finally cultivated had become "bored" with him and fell into the arms of the Korean Oppa.

In 2015, Liu Yifei and the actor Song Chengxian fell in love with each other during the filming of the movie "The Third Kind of Love". The two fell in love and couldn’t help but come together.

Chen Jinfei was furious when he learned of the matter. No matter how much he threatened and lured Liu Yifei, Liu Yifei, who was carried away by love, was unwilling to break up with Song Chengxian Oppa.

Not only that, Liu Yifei and Song Chengxian were also photographed by reporters when they were dating, and their relationship was exposed.

In order to be better together with Song Chengxian, Liu Yifei slowly distanced herself from Chen Jinfei, and her resources were also declining with the naked eye. However, with the nourishment of love, she was fearless, and the two once spread news that good things were coming.

Although Liu Yifei and Song Chengxian are in a foreign relationship and face the test of different regions, languages and habits, they love each other deeply, and they are both accommodating each other. They are a good match in appearance, and they are talented and beautiful, so they have received many people’s blessings.

He had thought that the "exotic couple" who were favored by others would be able to achieve success and become an enviable pair of immortals, but in the end, what everyone waited for was not the good news of their marriage, but the training of their breakup.

At the end of 2017, Liu Yifei and Song Chengxian broke up, and the two had a two-year relationship. The man said that the reason for the breakup was that the two were busy with work, and they gradually became estranged, eventually breaking up.

After breaking up, Liu Yifei quickly adjusted her mood and mentality. She wanted to return to her godfather Chen Jinfei, hoping to regain his favor and protection.

Unfortunately, Liu Yifei forgot a truth, no one will always wait for you to turn back. At this time, Chen Jinfei already has a new love by his side, and Chen Jinfei’s new love is none other than Yang Caiyu, who is 30 years younger than him.

Yang Caiyu has also been out for some years. Previously, she participated in film and television dramas such as "Youth Code", "Love in the 1980s", and "Portrait of 19 Years Old in Summer". Her debut has been tepid for many years.

At an event, Chen Jinfei met Yang Caiyu. The first time he saw Yang Caiyu, Chen Jinfei was attracted by her beauty and couldn’t help but gearing up to try it.

Chen Jinfei’s way of chasing women is very tyrannical. If he loves her, he will support her, and if he loves her, he will spend money. Needless to say, in terms of material things, he has everything he should have.

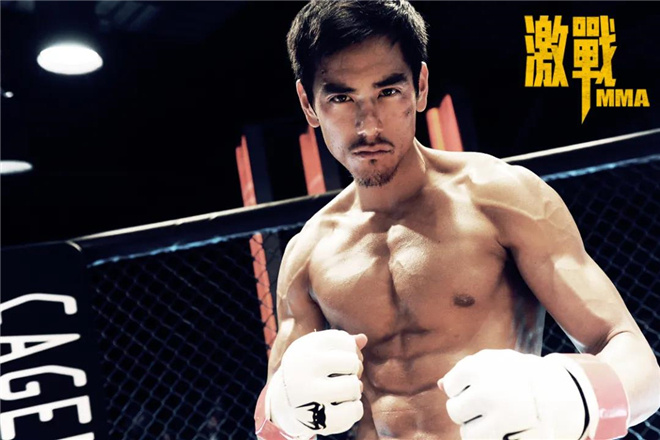

In fact, Chen Jinfei originally planned to play Liu Yifei in the movie "Youth", but she fell in love with Song Chengxian and alienated herself, so Chen Jinfei gave the movie to his new love, Yang Caiyu.

In this way, Yang Caiyu became Chen Jinfei’s new favorite, and became an instant hit with the support of Chen Jinfei. After the release of "Youth", Yang Caiyu became famous in a battle, which can be said to be all the hard work.

Because Yang Caiyu looked like Liu Yifei, many people speculated that Chen Jinfei would like Yang Caiyu because he saw Liu Yifei’s shadow in her, and Yang Caiyu also received the title of "Second Fei" (Second Concubine).

Chen Jinfei didn’t like her because Yang Caiyu looked like Liu Yifei. It was hard to say for the time being. It was certain that Yang Caiyu’s personality was much more upright and generous than Liu Yifei’s.

Yang Caiyu did not shy away from admitting the fact that he was with Chen Jinfei, generously recognized his love, and also affectionately turned Chen Jinfei into a "husband", showing his love and affection at every turn.

There were rumors that Chen Jinfei and Yang Caiyu had been secretly married. However, since neither of them admitted it, and there was no real evidence, the rumor was later put to rest.

Over the years, Chen Jinfei has been getting more and more moisturized, and his female companions have been changing constantly. Last year, Yang Caiyu and Chen Jinfei broke up, and the two have never been photographed in the same frame again.

On July 12 this year, the gossip media released a recent video of billionaire Chen Jinfei, claiming that he had captured an intimate picture of him buying a necklace with his little girlfriend, and his new relationship was exposed.

From the shooting footage, it can be seen that the little girlfriend is nestled sweetly in Chen Jinfei’s arms, and Chen Jinfei is as generous as ever, spending a lot of money to buy and buy with his new girlfriend.

According to media reports, Chen Jinfei’s new love is young and beautiful, pure in appearance, Liu Yifei and Yang Caiyu, it seems that after so many years, Chen Jinfei’s aesthetic has not changed at all, and he likes a type of beautiful woman.

On this side, Chen Jinfei lived in high spirits, chic and happy, while on the other side, Liu Yifei’s life was not so good.

Without the protection of her godfather, Liu Yifei’s resources have declined visibly. She desperately wanted to enter Hollywood and made a film "Mulan", but the word-of-mouth box office was double, and she still failed to wash off the label of "box office poison".

Fortunately, in the past two years, Liu Yifei has received some TV dramas, such as "Dream Hualu" and "Going to a Windy Place", in order to maintain the popularity. Although the scenery is no longer there, at least it has not been forgotten by the audience.

A few days ago, Liu Yifei was pushed to the forefront of the trend because of her endorsement of Bulgari.

Not for anything else, just because Bulgari overturned, in the official website, "TAIWAN" was positioned as a country, causing dissatisfaction among many netizens, and they shouted that the cooperating artists and image ambassadors would quickly terminate the contract.

Liu Yifei, one of Bulgari’s global spokespeople, chose to "pretend to be deaf and dumb", did not state her position, and did not respond.

Some netizens called on Liu Yifei to stand up and take a stand, and even asked her to terminate the contract with Bulgari. However, there were also sober netizens who reminded the dreamer "What’s the matter with Liu Yifei? She’s not Chinese".

So it seems reasonable that Liu Yifei has been living in the United States since the age of 10, and she can only be regarded as a Chinese-American, so she does not express that it is understandable whether to cancel the contract or not.

What’s more, Bulgari’s global spokesperson is the "honor" that all celebrities want to get, how could Liu Yifei easily terminate the contract.

Nowadays, Liu Yifei’s reputation is inexhaustible, her behavior is very fascinating, and her direction is also very fascinating. In addition to the few representative works that can be produced in the early years, there has been no support for her outstanding works in recent years.

And the name of her godfather Chen Jinfei and "Yangzhou Thin Horse" has become a lingering stain on her life.

Responsible editor: