★ Translate the whole text with full notes.

★40-year-old classics, all kinds of books are on the shelves.

★ Fully display the brilliance of ancient science and technology in China.

★ Essential introductory reading for scientific and technological masterpieces

★ Selected Items of Reading Guidance Catalogue for Primary and Secondary School Students by the Ministry of Education (Nine Chapters of Arithmetic and Heavenly Creations)

The Chinese nation has a civilization history of thousands of years, and has created splendid ancient culture, especially China’s ancient science and technology, such as papermaking, printing, gunpowder and compass, which have made great contributions to the progress of world civilization. Needham, a famous British scholar, pointed out after studying the history of world science and technology that before the middle of the Ming Dynasty, China’s inventions and discoveries far surpassed those of Europe at the same time; China’s ancient science and technology have been ahead of the rest of the world for a long time: China’s Zhouyi Suan Jing, written in the Qin and Han Dynasties, put forward a special case of Pythagorean theorem 500 years earlier than the West; Zhang Heng of the Eastern Han Dynasty invented the armillary sphere and the seismograph, more than 1,700 years earlier than Europe. Zu Chongzhi in the Southern Dynasties accurately calculated that pi was between 3.1415926 and 3.1415927, which was more than a thousand years earlier than that in Europe …

In order for today’s readers to inherit and carry forward the excellent traditions of the Chinese nation-being brave in exploration, good at innovation and good at discovery and invention, our society began to mobilize, plan, organize and publish this series of books as early as the 1980s. At that time, Mr. Hu Daojing (1913-2003), an old publisher and scholar of history of science, was invited as the editor-in-chief of the series. Under the guidance of Hu Lao, the work of selecting books and soliciting contributions was carried out.

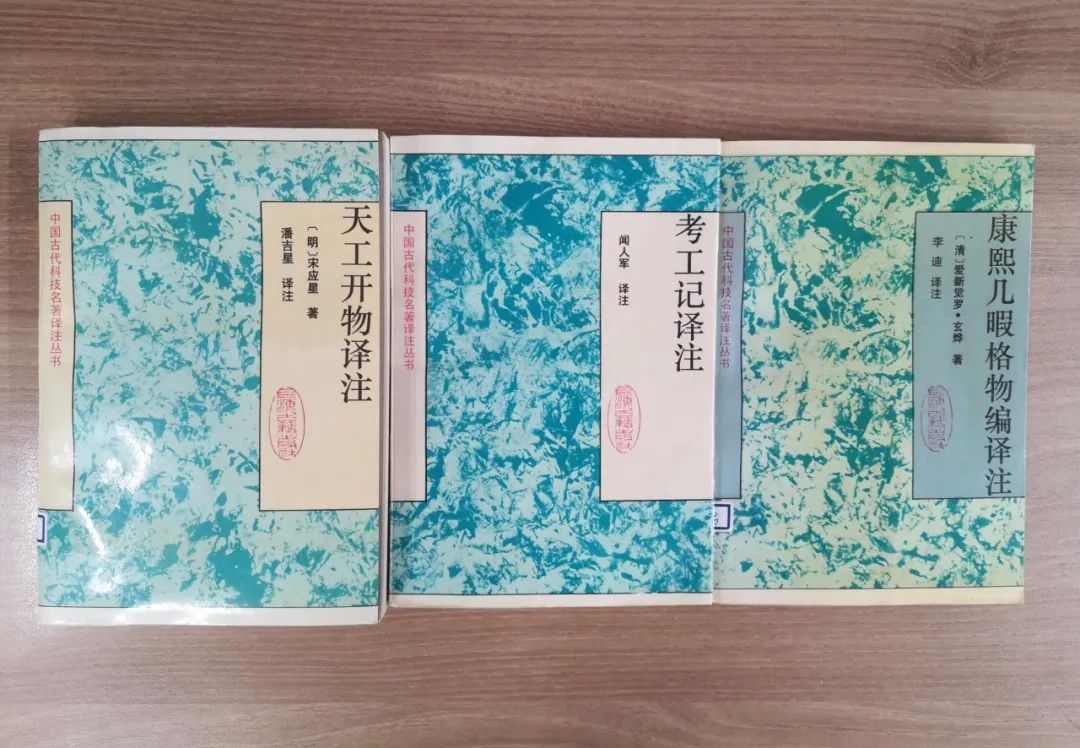

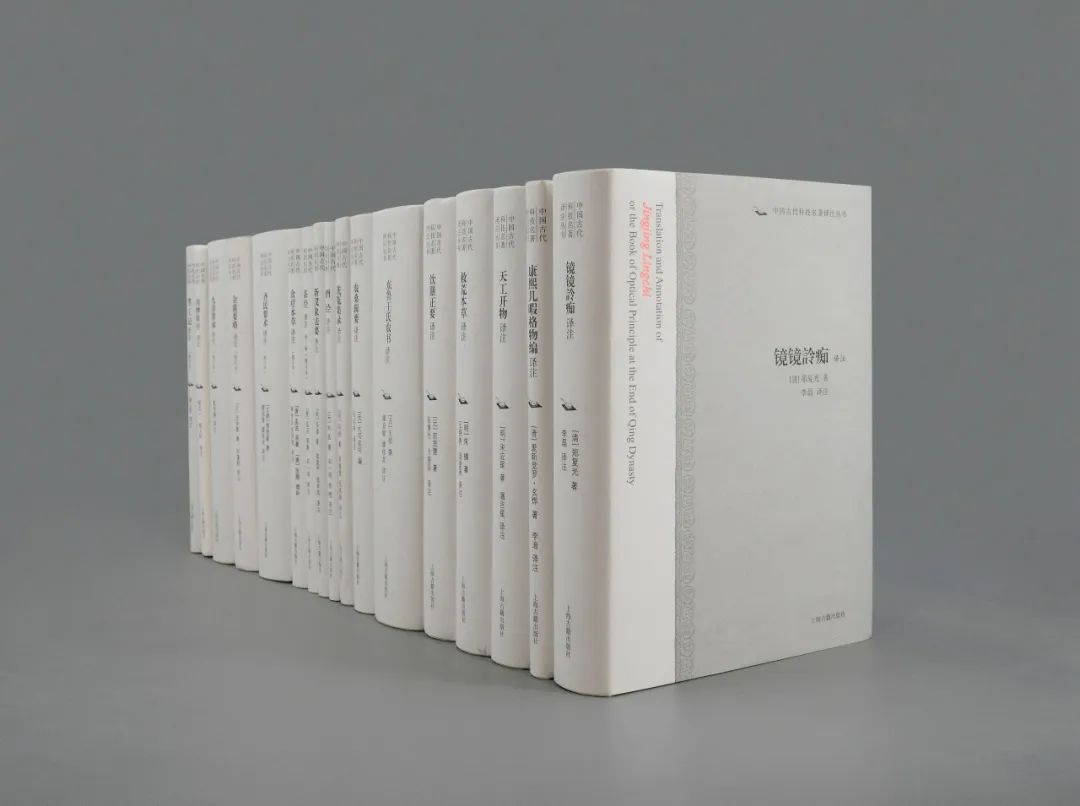

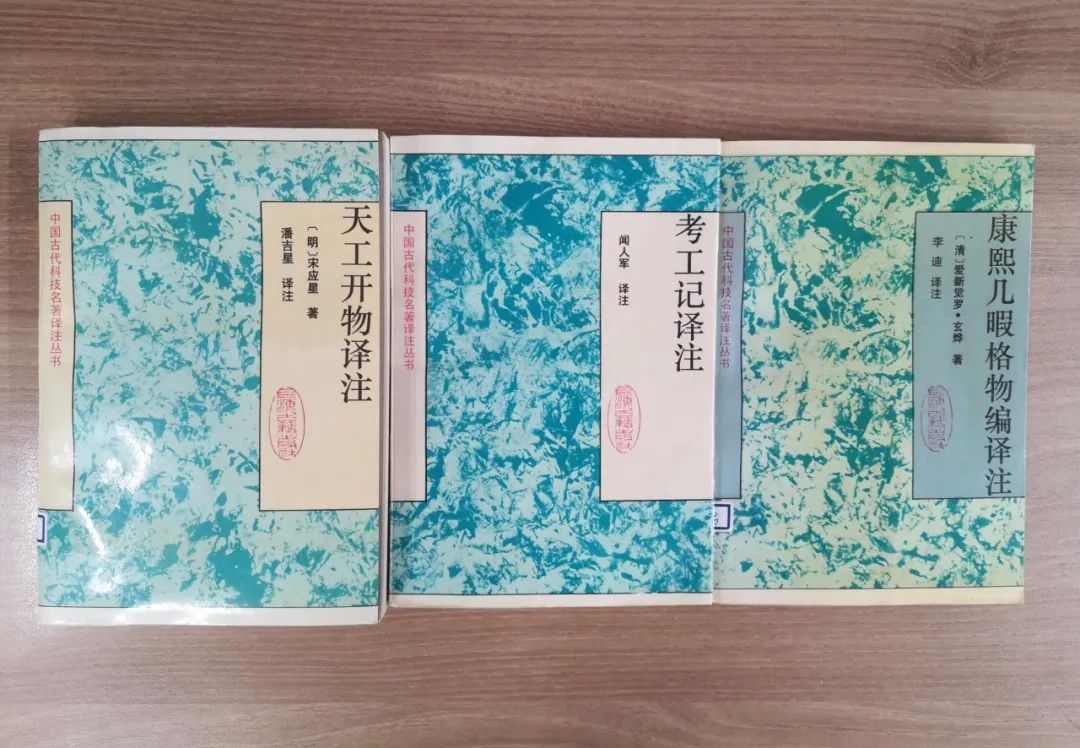

The series has been supported by many outstanding scholars and written in succession. After publication, it has also been welcomed by readers and achieved good social benefits. However, due to various reasons, only five kinds of books were published in the 20th century (Annotation of Kao Gong Ji, Annotation of Dietetic Materia Medica, Annotation of Wang’s Agricultural Books in Donglu, Annotation of Tiangong Kaiwu, Annotation of Compiling and Compiling the Things in Kangxi’s Leisure Time), so they had to be suspended. After Hu Lao’s death, the publishing of series is even more difficult.

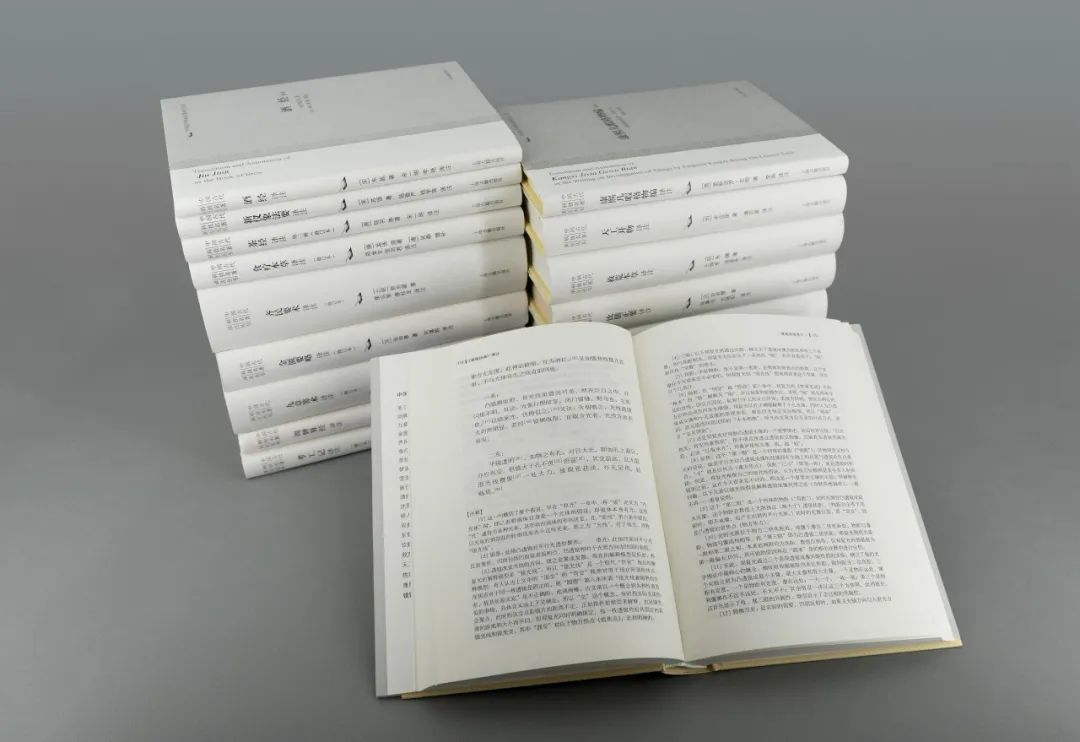

In the 21st century, our society decided to restart the publication of series. With the support of Shandong University, on the basis of the original, the bibliography was re-selected, the compilation style was revised, and the author was invited again to continue to complete the project perfectly.

The restart of the series has won the support of many old authors, especially Mr. Pan Jixing, a famous expert in the history of science and technology. He not only put forward suggestions such as revising the style, providing topics and recommending authors, but also generously promised to undertake the review of the English titles of this series. In addition, the series also invited many outstanding scholars, such as Guo Shuchun, a historian of mathematics, Liu Aiyun, a Chinese medicine expert, Zheng Jinsheng, an expert in the study of Chinese medicine history and literature, Miao Qiyu and Ma Zongshen, an agronomist, Gao Suijie, a forensic scientist, Cheng Zhenyi, Wen Renjun, Lu Jingyan, Zhang Binglun and Li Di, to write in succession.

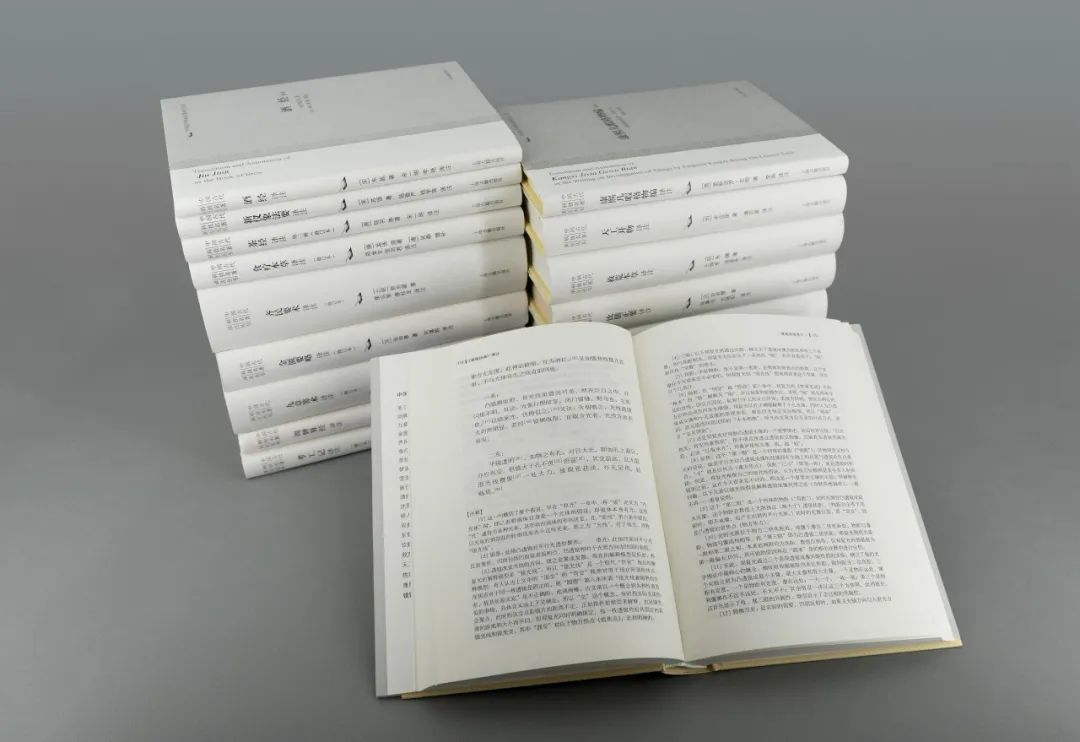

For ordinary readers, it is not easy to read China’s ancient scientific and technological classics. After 40 years of readers’ examination and several times of perfection by the author, this series of books has finally determined the style of "original text+annotation+translation", which integrates classic original text, detailed annotation and popular translation, which not only facilitates readers to easily learn China’s ancient science and technology, but also meets the needs of some readers to read the original text. It can be said that it is a necessary introductory reading for China ancient science and technology lovers.

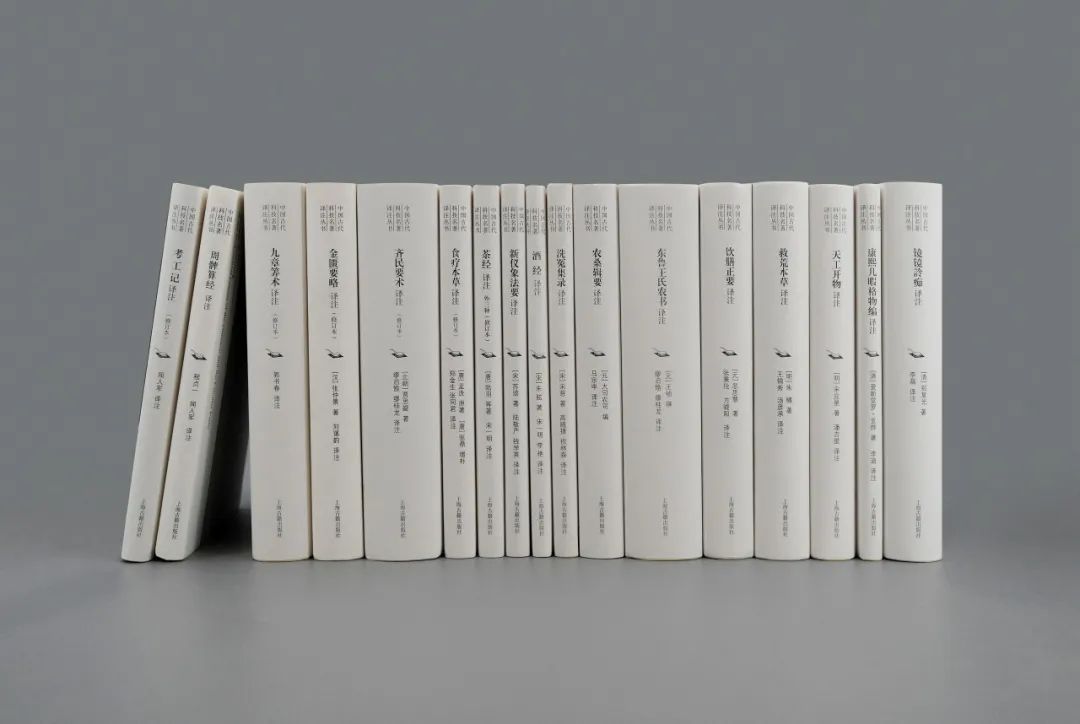

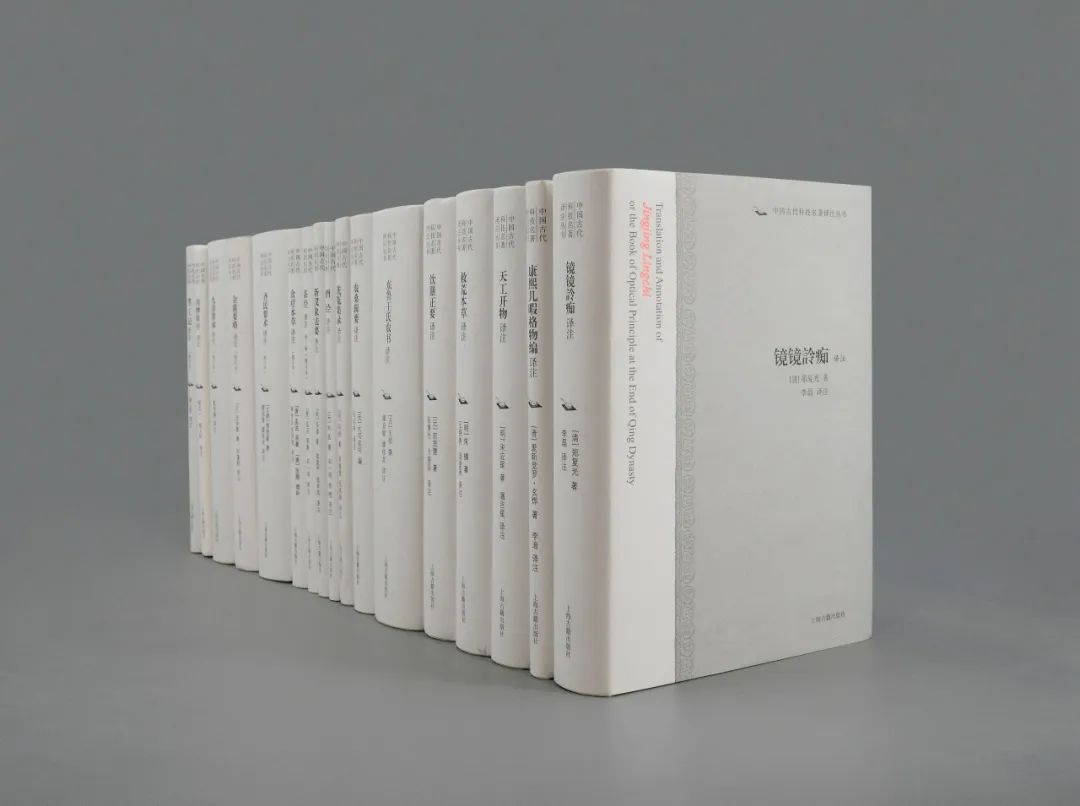

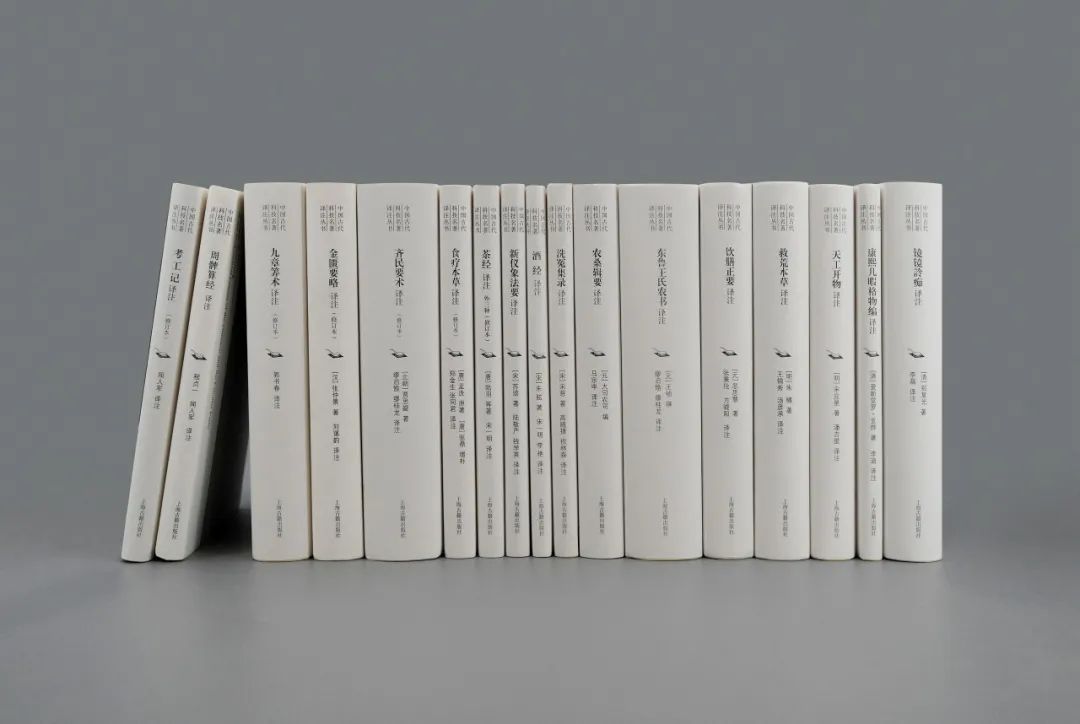

Up to now, the series has published 17 varieties, as follows:

Annotation of Kao Gong Ji (Revised Edition)

Annotation of Wen Renjun

Kao Gong Ji is the first compilation of handicraft techniques in China, which was written in the Spring and Autumn Period and the Warring States Period. It is the most important document to study the history of ancient technology in China. This edition is a part of Zhou Li, which is called Zhou Lidong’s Official Examination Record. As a part of the Confucian classics, Kao Gong Ji has been favored for a long time, with famous annotations and string recitation, and has been passed down to this day. At the beginning of Kao Gong Ji, it describes the origin and characteristics of "all-round work", and then points out the main types of work at that time, such as government-run handicrafts and household handicrafts, where there are 30 workers. It involves ancient car-making system, bronze casting system, bow and arrow weapon, leather armor system, ritual and music drinking and shooting system, building water conservancy system, pottery-making system and so on.

Notes on Zhou Pianjian’s Translation

Cheng Zhenyi and Wen Renjun’s Annotations

Zhou Piai suan Jing, the earliest arithmetic classic in Chinese history. Among them, the conversation between Duke Zhou and Shang Gao has the earliest written record of Pythagorean theorem. The book uses the simplest and most feasible method to determine the astronomical calendar, reveals the operating rules of the sun, the moon and the stars, covers the change of seasons and climate change, and includes the truth that the north and the south are polar and the day and night push each other, which provides a strong guarantee for the later generations to live and work. Since then, mathematicians of all ages have taken this book as a reference, and constantly innovated and developed on this basis.

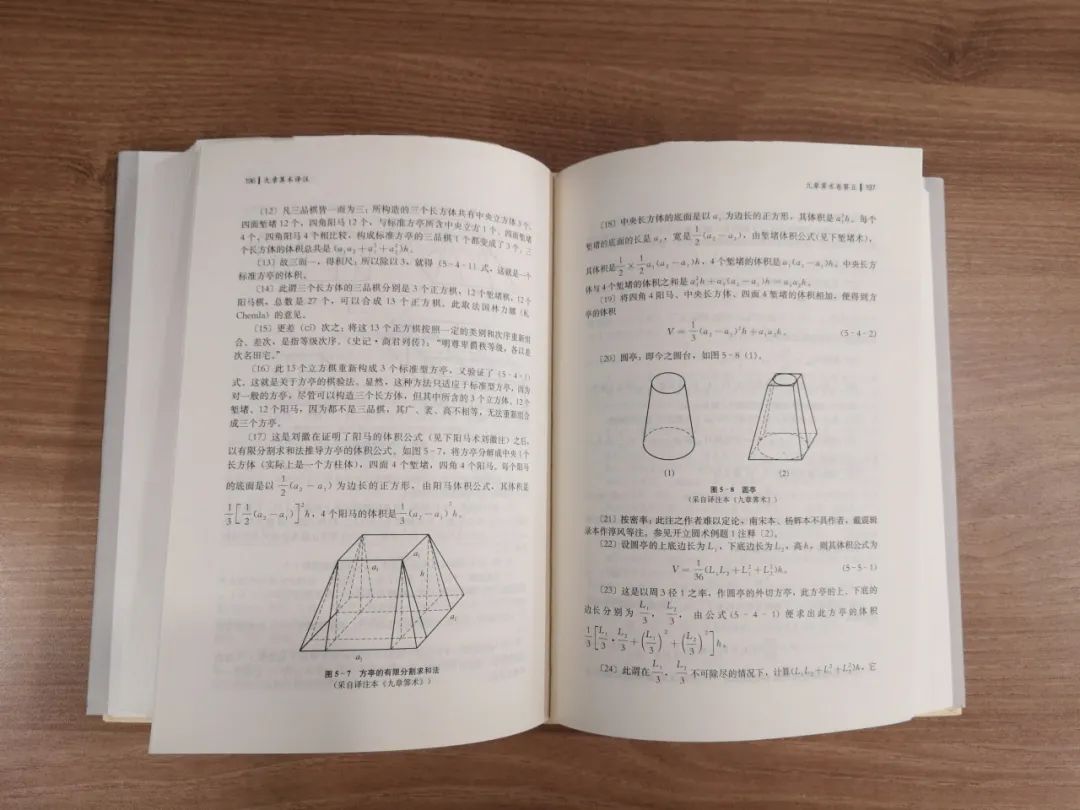

Annotations on Nine Chapters of Divination (Revised Edition)

Guo Shuchun’s translation

Selected as the "Reading Guidance Catalogue for Primary and Secondary School Students" by the Ministry of Education.

"Nine Chapters of Divination", an important kind of ten books for calculating classics, has always been regarded as the first one for calculating classics. The book systematically summarizes the mathematical achievements in the Warring States, Qin and Han Dynasties, and plays an important role in the history of Chinese mathematics. The revised edition was launched in 2020, which is more perfect in content than the original edition.

Related reading:

A Brief Interpretation of the Golden Chamber (Revised Edition)

By Zhang Zhongjing

Liu aiyun’s translation

Synopsis of the Golden Chamber is the earliest monograph on miscellaneous diseases in China. There are more than 60 kinds of diagnosis and treatment methods and 205 prescriptions. Many of these prescriptions have been widely used in clinic for thousands of years and are called "the ancestors of medical prescriptions". This book has high guiding significance and practical value, and has a great contribution and far-reaching influence on the development of clinical medicine in later generations. The revised edition was launched in 2016, and many of them were supplemented and improved.

Annotation of Qi Min Yao Shu (Revised Edition)

[Northern Dynasties] By Jia Sixie

Annotations of Miao Qiyu and Miao Guilong

Qi Min Yao Shu is the earliest and most complete ancient agricultural monograph in China. A total of ten volumes, detailing the ancient agricultural and sideline production technology and experience, covering almost all the contents of ancient farm management activities, can be called "the encyclopedia of ancient agricultural technology in China". The revised edition was launched in 2020, with many additions in content.

Related reading:

Translation notes of dietotherapy materia medica (revised edition)

[Tang] Meng E’s original work

[Tang] Justin Cheung added.

Translated Notes by Zheng Jinsheng and Zhang Tongjun

The earliest monograph of "dietotherapy" in China, the daily diet and health preservation of people in Tang Dynasty. Materia Medica for Dietotherapy, written by Meng Huang in Tang Dynasty and supplemented and adapted by Justin Cheung, was a famous monograph on food therapy and nutrition in Tang Dynasty, which recorded the medicinal efficacy, indications and various taboos of more than 260 kinds of common foods and collected a large number of dietotherapy prescriptions. Materia Medica for Dietotherapy is the most abundant book in Tang Dynasty, and comprehensively summarizes the dietotherapy experience at that time. Originally lost for a long time, the author translated it according to the notes of the lost edition, and checked it with many residual editions and other classics. Attached are two indexes: "explanation of terms" and "food and medicine".

Notes on the Translation of Tea Classics (External Three Kinds) (Revised Edition)

[Tang] Lu Yu is waiting

Song Yiming’s translation

Annotations on Tea Classics (three kinds outside) includes four monographs on tea studies: Lu Yu’s Tea Classics in the Tang Dynasty, Cai Xiang’s Tea Records in the Song Dynasty, Huang Ru’s Tea Tasting Notes, and Xu Cishu’s Tea Shu in the Ming Dynasty. Among them, The Book of Tea is particularly famous. It is the earliest, most complete and comprehensive monograph on tea in China and even the world, and is known as the "encyclopedia of tea". The revised edition was launched in 2017, and many of them were supplemented and improved.

Related reading:

Notes on the New Instrument and Image Method

[Song] By Su Song

Translated Notes by Lu Jingyan and Qian Xueying

"The Essentials of New Instrument and Image" is Su Song’s explanation of the manufacture and use of instrument and image platform, which has a high position in the history of ancient science and technology in China. Although it has few words, it is a tour of the great achievements of Chinese literature the day before yesterday in the 11th century, an exhibition of the manufacturing technology of ancient astronomical instruments in China, and also reflects the brilliant achievements in many fields such as statics, dynamics, optics, mathematics, mechanical manufacturing and automatic control.

Interpretation of wine classics

[Song] By Zhu Jian

Translated Notes by Song Yiming and Li Yan

Interpretation of wine classics is the first monograph in China that comprehensively and systematically discusses the technology of koji-making and wine-making. A total of three volumes, the first volume discusses the development history of wine; In the middle volume, there are three categories and thirteen kinds of ingredients for each song; The next volume records the brewing process and the brewing technology of various wines. The book records the brewing methods of white sheep wine, yellow rice wine, chrysanthemum wine, tea wine and wine.

Related reading:

Annotations on the Collection of Wrongs

[Song] By Song Ci

Translated Notes by Gao Suijie and Zhu Linsen

The six-volume Collection of Injustice is the first classic of forensic medicine in ancient China that systematically summarizes the experience of corpse examination, and it is also the earliest and more complete monograph of forensic medicine in the world. Since the Southern Song Dynasty, this book has become the blueprint of official corpse examination in past dynasties, and it was once the criterion of criminal examination in Song, Yuan, Ming and Qing dynasties. This book has been translated into many foreign languages and occupies a very important position in the history of forensic medicine in the world.

Notes on the Summary of Agriculture and Mulberry

Editor-in-chief of Dasi Agriculture Department

Ma Zongshen’s translation

The Seven-volume Compendium of Agriculture and Mulberry is a comprehensive agricultural book compiled by the senior agricultural department in the early Yuan Dynasty. Most of the contents are quoted from Qi Min Yao Shu, Shi Nong Must Use, Wu Ben Xin Shu, Si Shi Bian Yao, Han Shi Zhi Shuo, etc. Although they are excerpts, they take their essence and abandon the exegesis of names and superstition. There are also some words written by editors, all of which are marked with "new additions". On the basis of inheriting the previous generation of agricultural books, this book has improved and developed the techniques of intensive cultivation, mulberry planting and sericulture in the northern region; It paid special attention to the cultivation techniques of cash crops such as cotton and ramie, and it was a practical agricultural book at that time.

Annotation of Wang’s Agricultural Books in Donglu

[Yuan] Written by Wang Zhen

Annotations of Miao Qiyu and Miao Guilong

This book is a master of agronomy in Yuan Dynasty in China. This book consists of three parts: "Nong Sang Tong Ji" is about the planting and storage of crops, the cultivation of fruit trees and the raising of livestock and poultry; Baigupu is an introduction to the cultivation of various specific crops such as whole grains. The use and production of traditional farm tools, water conservancy equipment, silk reeling and weaving equipment in China are introduced in detail in the Atlas of Agricultural Machinery.

Drinking food is about to be translated

[Yuan] By Hu Sihui

Translated Notes by Zhang Binglun and Fang Xiaoyang

Eating and drinking is the first monograph on nutrition in China. It was written by Hu Sihui, a imperial doctor who ate and drank in Yuan Dynasty. He is in charge of court diet and medicine tonic matters, and also knows Mongolian and Chinese medicine, and has accumulated rich knowledge of nutrition. He compiled this book by collecting various herbal medicines, famous doctors’ recipes, rare and unusual dishes used in court daily life, decoction and paste, and neutral taste tonic of cereals, fruits and vegetables.

Related reading:

Herbal translation of famine relief

[Ming] By Zhu Yun

Translated Notes by Wang Jinxiu and Tang Yancheng

Herbal Medicine for Disaster Relief, the earliest specialized book on agronomy and botany aiming at disaster relief in Chinese history. As a plant atlas in the early Ming Dynasty (early 15th century AD), it describes the plant morphology and records the edible plant resources in the Central Plains of China in the Ming Dynasty. The translator especially emphasizes that readers are advised not to try unfamiliar plants easily.

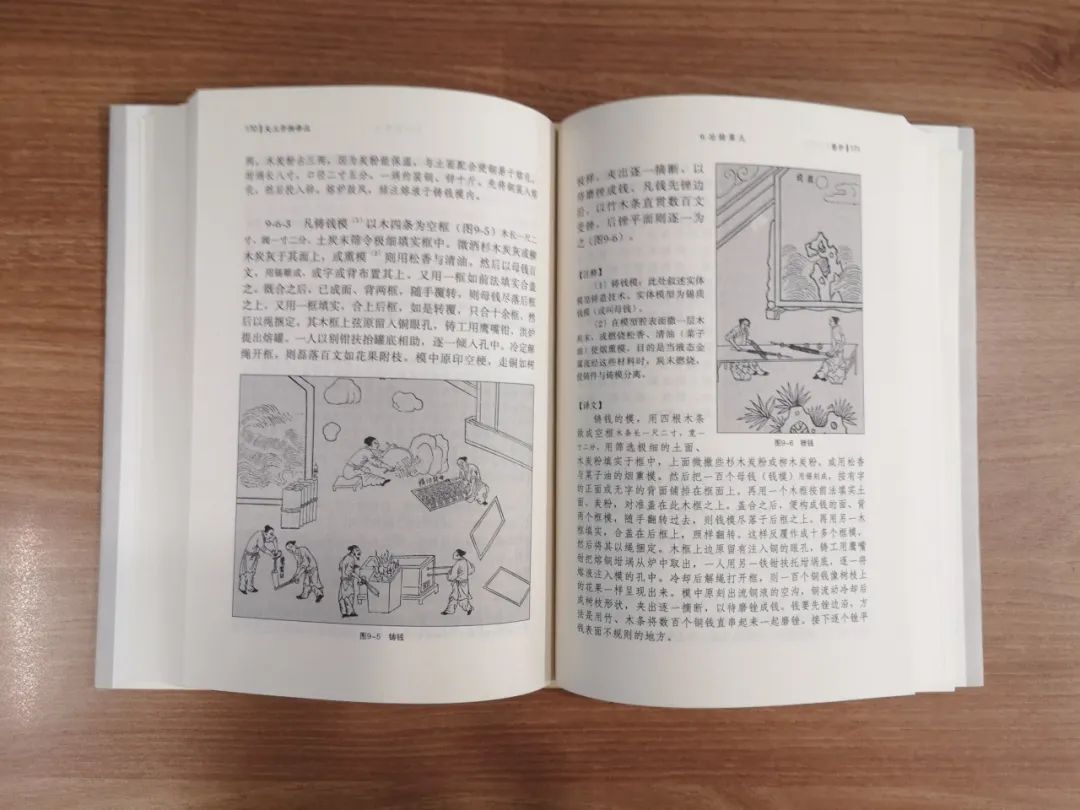

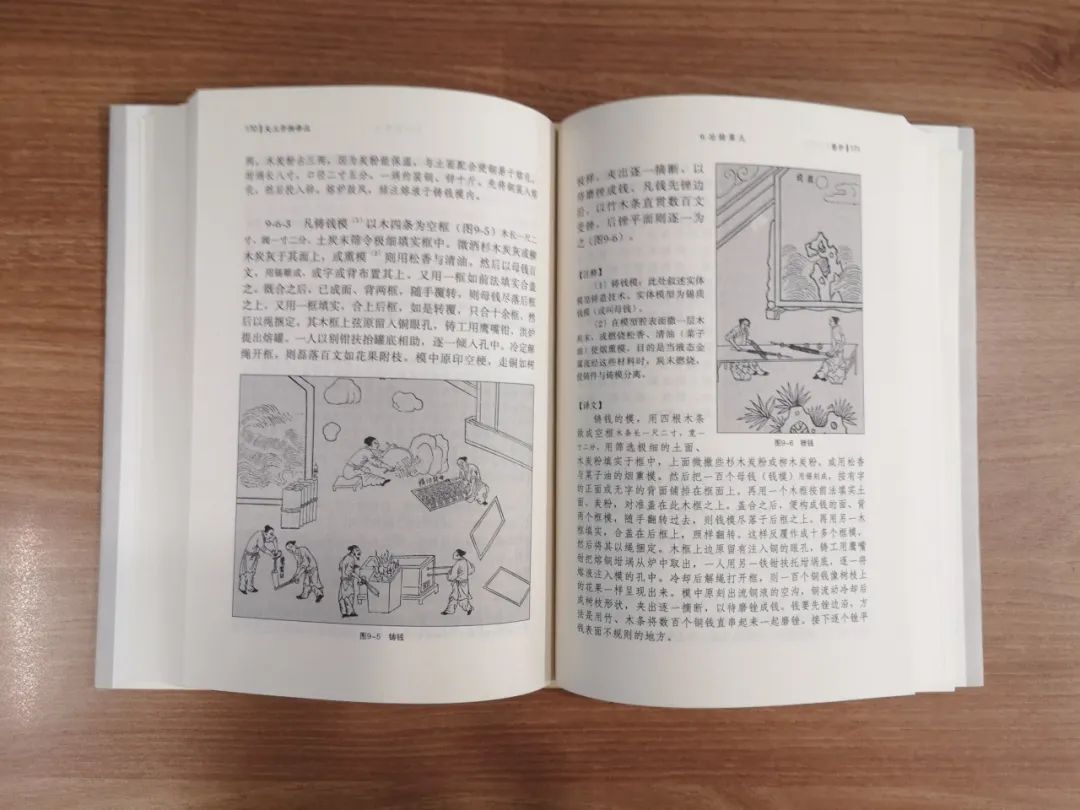

Tiangong Kaiwu

[Ming] By Song Yingxing

Pan Jixing’s translation

Selected as the "Reading Guidance Catalogue for Primary and Secondary School Students" by the Ministry of Education.

"Heavenly Creations" is one of the "four famous scientific and technological works" in China in the late Ming Dynasty, which occupies a very important position in the history of ancient science and technology in the world and has been translated into Japanese, English, German, French and other languages. It systematically and comprehensively describes the production technology and experience of 18 production departments of agriculture, industry and handicraft industry in China from 16th to 17th century. There are more than one hundred illustrations in the book.

Related reading:

Notes on the compilation of Kangxi’s leisure objects

[Qing] By Aisingiorro Xuanye

Li Di’s translation

This book is a note made by Emperor Kangxi of the Qing Dynasty, which mainly records Kangxi’s investigations and experiments on astronomy, geography, paleontology, animals, plants, medicine and other disciplines in his spare time, and there are many insights.

Mirror-mirror delusion

[Qing] By Zheng Fuguang

Annotation by Li Lei

Crazy in the Mirror, the earliest monograph on physics in China. Its content not only has the characteristics of traditional physics, but also has great originality. Zheng Fuguang, the author of this book, made the earliest astronomical telescope in China. Regarding the title of the book, the author Zheng Fuguang explained in the preface: "Take the object as the object, that is, the objective lens. It can be popularized by this book "The Theory of Far Mirror". Dare to call you xian, and tell me how stupid I am. " That is, "my humble opinion on the problem of looking at things in the mirror."

Original title: "It is recommended by a good book, and it is selected as an introductory reading for famous scientific and technological works."

Read the original text